Calastone, the largest global funds transaction network, today releases a study revealing that, despite recent hype, environmental, social and governance (ESG) investing is not as significant for young investors as we may have believed.

Calastone’s survey – which assessed over 3,000 people aged 22-34 across Hong Kong, the UK, France, Germany, the US and Australia – shows that most millennials are not driven by a sense of social responsibility when it comes to investing. Ethical considerations are ranked the lowest by global millennials, particularly so by those in Hong Kong, with only 26% of them considering “investment in ethical funds, causes & products” an important criterion. Instead, long-term returns (58%) and low fees (52%) are valued most by Hong Kong millennials.

Hong Kong Millennials Save and Invest More than Global Peers

Hong Kong millennials are heavily focused on returns; they appear to be more financially aware than their global peers and are proactive in financial planning. Almost half of local millennials (48%) claimed that they are interested in finance/ investing, above the global average of 38%. Education could be a key factor underpinning generally higher level of financial literacy in Hong Kong. In fact, millennials in Hong Kong are the most highly educated in the survey sample, with four-fifths having achieved Bachelor’s degree level or above.

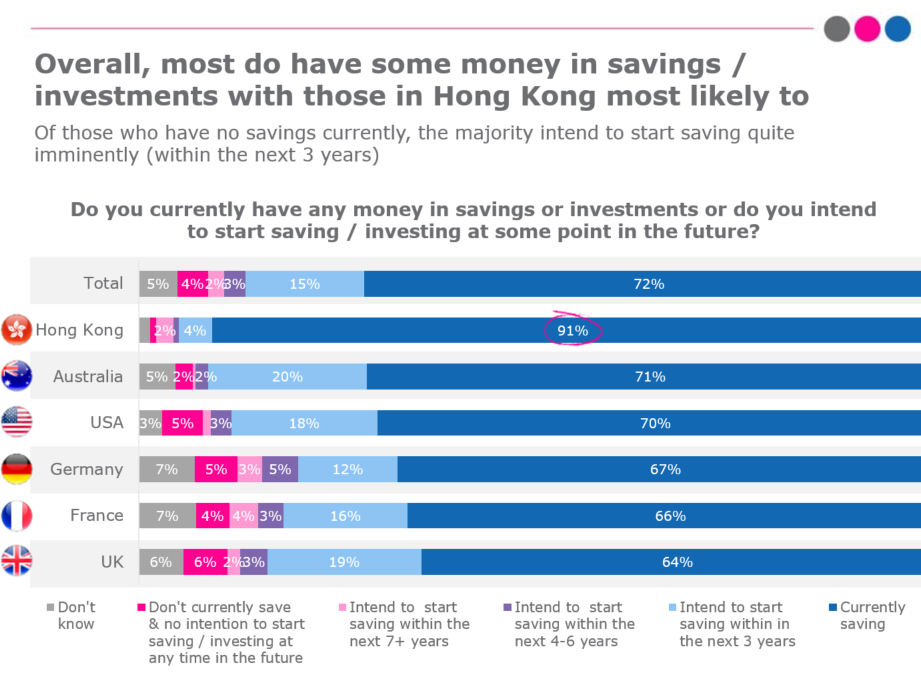

Young people in Hong Kong have a far higher level of disposable assets, standing at HK$250,000, compared to a global average of HK$140,000. This can be partly attributed to the fact that Hong Kong millennials’ level of savings and investments are also superior to other countries examined, with a majority (91%) saying they save or invest, dwarfing the global average of 72%.

Another contributing factor is that they do not spend as much on living costs. For example, Hong Kong sees the highest percentage of millennials (39%) living rent free with their relatives, which is twice the global average (19%).

Great Potential for Asset Managers to Find Success in Hong Kong

All these findings indicate that Hong Kong is a promising market for asset managers. To reap the potential rewards in this market, asset managers need to recognize their changing client demographics and be aware of this new group of investors: relatively financially sophisticated, open-minded millennials who have a fairly sizeable asset pool to invest.

To capture this group of emerging investors, asset managers need to review their current service offerings and ensure that they have an effective digital strategy. Hong Kong millennials are comfortable with the use of technology and prefer to managing their lives, including investments, digitally. When choosing investment funds, 36% of Hong Kong millennials highlighted that having the ability to manage their investment via digital platforms was a key consideration.

Offering smart digital tools and delivering a great online experience are essential to win over the millennial investors, who are digital-by-design. Those asset managers who are able to do this successfully will be best placed to convert Hong Kong millennials interest in saving and investing into a growth in assets under management.

Leo Chen, Managing Director, Head of Asia at Calastone comments:

“Hong Kong millennials are emerging as a powerful investment force. We see promising opportunities for asset managers in the local market; despite margin pressure, regulatory scrutiny and other challenges in recent years. To attract this group of investors and to increase market share in a competitive environment, it is important for asset managers to embrace digitalisation and leverage technology, which is a key part of the millennials’ lives.

Big tech companies such as Apple, Amazon and Netflix have been successful in using technology to offer intuitive services and relevant products and to accommodate millennials’ changing habits. While these companies have not yet made a foray into asset management, many experts believe they will do so at some point. Asset managers must act now to innovate and to improve customer experience with digital capabilities and omnichannel support.”

To access Calastone’s full survey, you can follow the link at: https://www2.calastone.com/millennialsresearch