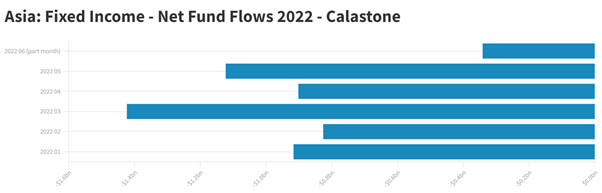

The bear market in bonds has driven dramatic outflows from fixed income funds across Asia, according to the latest analysis of fund flow data by Calastone, the world’s largest global funds network. Though investors in all of Calastone’s territories around the world have been markedly more negative on fixed income in 2022, those in Asia-Pacific have been especially bearish.

Following a record $25.3bn inflow to bond funds in 2021 across Calastone’s global network, investors in 2022 had withdrawn $9.8bn by the middle of June. 57% of this, equivalent to $5.5bn, was down to sellers from across Asia. Those in Hong Kong were the most negative, pulling $3.3bn from their bond holdings, but investors in Singapore and Taiwan were also significant net sellers, reducing their holdings by $1.6bn and $686m respectively. Investors in mainland China and the Phillippines followed suit.

Here are some key insights from this report:

The complexion of flows shows a clear preference for shedding risk. More than one quarter of net selling of fixed income funds by Asian investors came from funds investing in riskier high yield sovereign or corporate bonds, roughly double their share of market capitalization. Taiwanese investors were especially negative on this category – it accounted for more than half their net sales of fixed income funds.

Leo Chen, Head of Asia at Calastone explained: “In most of the world, Covid-19 is no longer having a severe health impact, but economic contagion is gathering pace, and restrictions continue to disrupt society in Hong Kong and mainland China more than most. A bear market has ensued across a range of asset classes. Equity markets are down only a little more than bond markets, proving that the historically unusual correlation they have shown on the upside (related to central bank QE programmes) has tracked the downside too. The riskiest assets are taking the biggest hit, however.

In fixed income markets, yields have risen most for lower rated bonds across corporate and sovereign issuers. Perhaps counterintuitively, high yield bonds are less sensitive to rising market interest rates because they tend to have shorter maturities and higher coupons, which makes them less sensitive to the time value of money. The outflows from the high yield category have instead been driven by rising credit risk – high yield bonds are very sensitive to a deteriorating economic outlook as their issuers are less typically less resilient and this has spooked investors.”

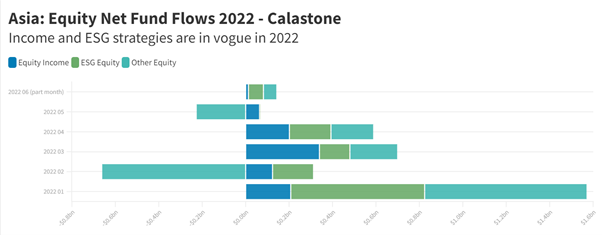

Despite their flight from fixed income funds, investors in Asia have been more positive on equity funds than those in Europe and the UK and also more positive than their Australian neighbours, though their enthusiasm has waned significantly compared to 2021. Across all Calastone’s Asian territories, investors added $2.1bn to their equity holdings between January and May, three quarters less than the $8.1bn they added in the same period in 2021. ESG funds accounted for just over half the net inflow between January and May ($1.1bn) while income funds made up for almost a third ($609m).

Hong Kong residents were the main buyers, accounting for just over half the net inflow from the region ($1.1bn) between January and May. Hong Kong’s residents cut their net investment by half year-on-year, a much smaller reduction than the regional average. There was nevertheless a clear preference for lower risk equity income funds, which accounted for almost half the new money they committed to equities (+$510m). ESG funds were also popular (+$447m), part of a trend of relatively rapid adoption of ESG as an investment strategy that began in 2021, somewhat later than in the UK and Europe.

Singapore’s investors showed the biggest reduction in the new capital they added to equity funds, down from $4.5bn in the first five months of 2021 to just $307m between January and May 2022. Singapore’s investors were more negative on every major category of equity fund. They cut their purchases of income funds significantly less than other categories, however. Meanwhile, Taiwanese investors reduced net inflows by three fifths to $267m. They favoured ESG funds above all others, adding $536m to their ESG equity funds holdings while withdrawing $269m from non-ESG funds.

Leo Chen added: “Income funds have been out of favour with investors for years as tearaway technology stories dominated the global investment narrative, while more traditional industries delivering slow growth but lots of cash for investors went relatively unloved. In an inflationary environment, income is back as a theme. This is because income-generating stocks are ‘low duration’ assets whose value derives in large part from near-term cash flow, rather than more speculative assessment of future growth prospects.

The popularity of ESG funds has grown exponentially in the last four years. ESG funds are not inherently any less risky than regular equities. The growth profile or income generation of companies with good ESG credentials is likely to be quite similar to other kinds of companies, once sector differences are allowed for. It would therefore be a misrepresentation to suggest buying of ESG is part of the risk-off trade we are seeing across other asset classes. The key point is that ESG is coming from a very low base – assets under management remain a tiny fraction (less than 4%) of equity funds overall – and it is in a clear structural growth phase. That means there is a both a strong bias among investors towards buying and also a relatively small pool of assets that could suffer selling activity.”