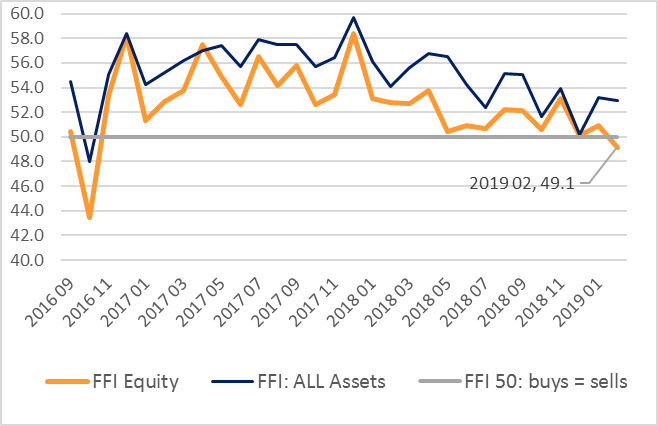

Equity funds saw the first net outflows in more than two years in February, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds transaction network. UK Investors pulled £215m out of their equity fund holdings, taking the FFI: Equity to 49.1 (any reading below 50 indicates outflows), its lowest level since the run-up to US presidential election in 2016.

Chart: Calastone FFI: Equity v FFI: All Assets

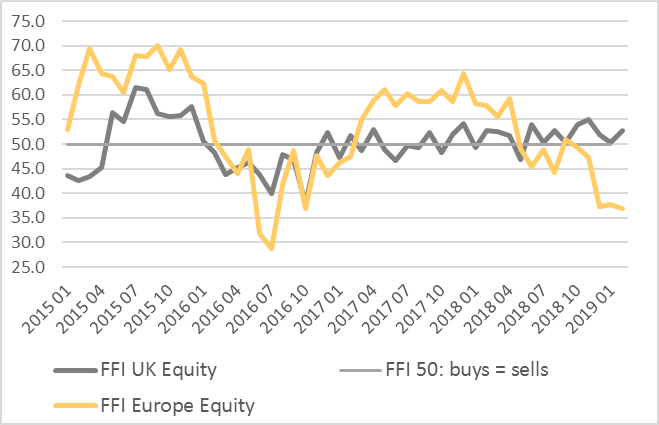

Most categories of equity fund saw outflows in February, but heavy selling of European funds was the key driver. European equity funds have seen outflows in nine of the last ten months. February saw no slowdown in that trend, as £292m left the category. The FFI: Europe Equity registered an exceptionally low 37.0 in February, in line with December and January. This not only indicates net outflows (i.e. sells greater than buys), but also that there was very little two-way trading – in fact, selling activity in European funds was almost twice as large as buying activity. Elsewhere equity funds focused on emerging markets, north America and specific sectors also saw outflows, while equity income funds saw their 22nd consecutive month of net selling as investors judged that equity yields were less attractive now compared to fixed income. UK equity funds bucked the trend, as new money flowed in to the tune of £160m. Global funds also enjoyed inflows.

Chart: Calastone FFI: UK Equity v FFI: Europe Equity

Most categories of equity fund saw outflows in February, but heavy selling of European funds was the key driver. European equity funds have seen outflows in nine of the last ten months. February saw no slowdown in that trend, as £292m left the category. The FFI: Europe Equity registered an exceptionally low 37.0 in February, in line with December and January. This not only indicates net outflows (i.e. sells greater than buys), but also that there was very little two-way trading – in fact, selling activity in European funds was almost twice as large as buying activity. Elsewhere equity funds focused on emerging markets, north America and specific sectors also saw outflows, while equity income funds saw their 22nd consecutive month of net selling as investors judged that equity yields were less attractive now compared to fixed income. UK equity funds bucked the trend, as new money flowed in to the tune of £160m. Global funds also enjoyed inflows.

Chart: Calastone FFI: UK Equity v FFI: Europe Equity

As capital flowed out of equities in February, so it flowed into bonds. Fears of a global economic slowdown have caused a flattening in the yield curve as rising short-term interest rates have narrowed the gap with long-term interest rates. That improves the relative attractiveness of lower risk, short-term bonds, highlighting them as a relative safe-haven in volatile times. The FFI: Bonds registered 55.6, its highest reading since September. In value terms, this translated into net inflows of £426m to fixed income funds in February.

Real estate funds performed poorly for the fifth consecutive month, with outflows larger now even than in the aftermath of the Brexit referendum which caused huge disruption to the sector [please contact us for a copy of our special focus piece on the real estate sector].

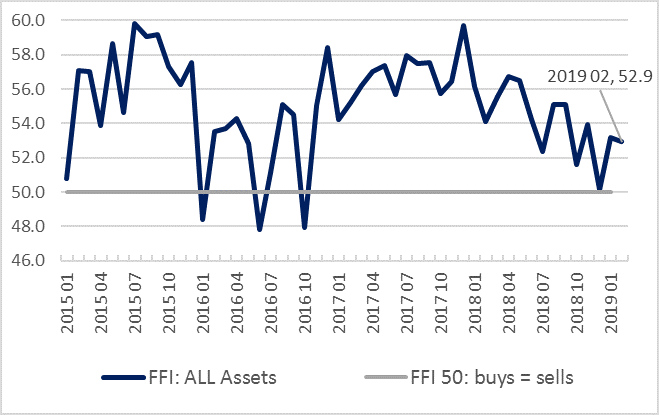

Overall, the Calastone FFI: All Assets registered a modestly positive 52.9 in February as perennial inflows to mixed asset funds and the strength in bonds offset weakness in equities and real estate.

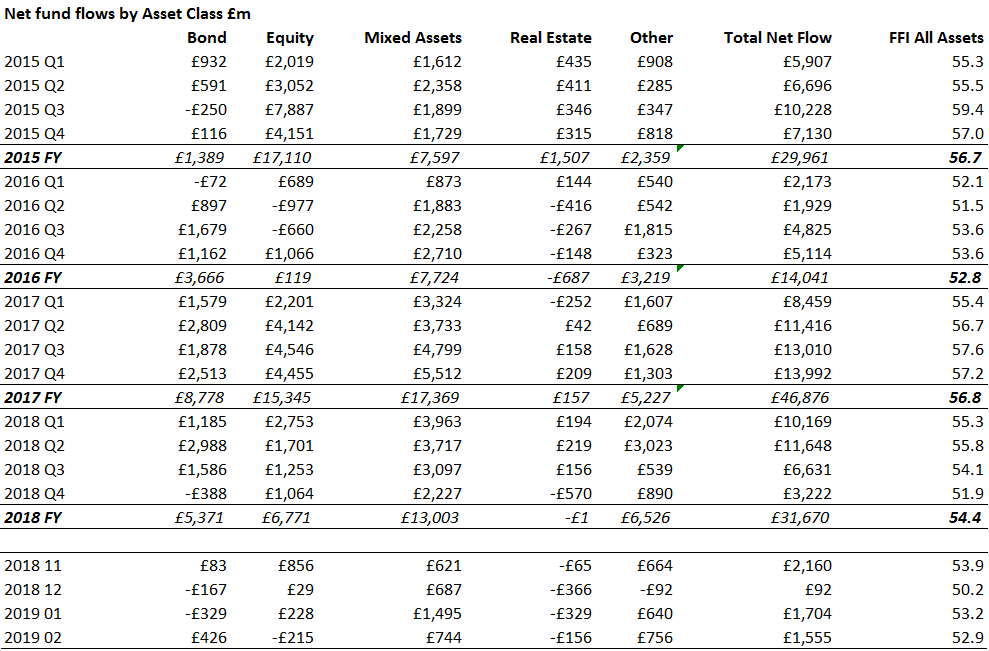

Chart: Calastone FFI: All Assets

As capital flowed out of equities in February, so it flowed into bonds. Fears of a global economic slowdown have caused a flattening in the yield curve as rising short-term interest rates have narrowed the gap with long-term interest rates. That improves the relative attractiveness of lower risk, short-term bonds, highlighting them as a relative safe-haven in volatile times. The FFI: Bonds registered 55.6, its highest reading since September. In value terms, this translated into net inflows of £426m to fixed income funds in February.

Real estate funds performed poorly for the fifth consecutive month, with outflows larger now even than in the aftermath of the Brexit referendum which caused huge disruption to the sector [please contact us for a copy of our special focus piece on the real estate sector].

Overall, the Calastone FFI: All Assets registered a modestly positive 52.9 in February as perennial inflows to mixed asset funds and the strength in bonds offset weakness in equities and real estate.

Chart: Calastone FFI: All Assets

Edward Glyn, Calastone’s Head of Global Markets, comments: “Stock markets have recovered dramatically from their December lows. Some commentators are calling this a bear-market bounce, and higher share prices have seemingly prompted investors to make the most of the uptick and pull capital out of their equity fund holdings. Sentiment around European equities in particular is relentlessly negative as the economic news from the eurozone gets steadily worse. The picture for UK funds is much brighter however. The valuation of UK shares is currently extremely cheap both compared to their history over the last 30 years, but also compared to other countries as Brexit has kept international investors well away from UK assets. UK investors are clearly snapping up bargains in the hope that a cliff-edge no-deal Brexit is now off the table.

It’s quite natural to see bonds and equities move in opposite directions because they have very different risk profiles. As global risks have risen, so investors have moved away from riskier funds, switching steadily lower-risk options over the last three months.”

Edward Glyn, Calastone’s Head of Global Markets, comments: “Stock markets have recovered dramatically from their December lows. Some commentators are calling this a bear-market bounce, and higher share prices have seemingly prompted investors to make the most of the uptick and pull capital out of their equity fund holdings. Sentiment around European equities in particular is relentlessly negative as the economic news from the eurozone gets steadily worse. The picture for UK funds is much brighter however. The valuation of UK shares is currently extremely cheap both compared to their history over the last 30 years, but also compared to other countries as Brexit has kept international investors well away from UK assets. UK investors are clearly snapping up bargains in the hope that a cliff-edge no-deal Brexit is now off the table.

It’s quite natural to see bonds and equities move in opposite directions because they have very different risk profiles. As global risks have risen, so investors have moved away from riskier funds, switching steadily lower-risk options over the last three months.”