Our recent research with Global Custodian highlights significant strides being made in tokenisation across the financial services industry. This comprehensive study sheds light on the current trends, challenges, and future prospects of tokenisation, framing a critical discussion during a recent webinar hosted by Global Custodian – “Getting to Grips with Tokenisation.” We participated in a panel discussion, where Adam Belding, our Chief Architect, discussed these developments with Anna Matson, Senior Vice President, Digital Assets & Financial Markets, Northern Trust, and Ryan Marsh, Global Head of Digital Assets & Innovation, Citi.

The Tokenisation Landscape: Current State and Predictions

Tokenisation, the process of converting rights to an asset or pool of assets into a digital token on a distributed ledger technology (DLT) platform, is no longer just a futuristic concept but a burgeoning reality. As Chris Lemmon, the panel’s moderator, pointed out, industry research forecasts that by 2030, assets worth approximately $16 trillion will be tokenised, making up around 10% of global GDP. At Calastone, our focus has been steadfast on ensuring that tokenisation not only simplifies the investment landscape but also enhances it, breaking away from the age-old structures that have governed mutual funds for a century.

Adam emphasised in the webinar the increasing appetite for tokenisation within asset management. “We’ve seen a real uptick in appetite and a change in potential models over the past 18 months,” he noted. This enthusiasm is not isolated, as our joint research with Global Custodian found that over 85% of fund managers plan to roll out tokenised funds within the next three years.

Moreover, the majority of respondents indicated that within the next six to seven years, tokenised funds are expected to become a significant part of active fund offerings. Specifically, 44% of respondents anticipate launching tokenised funds as their main new active fund vehicles in this time frame, compared to 29% for ETFs and 27% for mutual funds. This trend highlights the growing dominance of tokenised funds over traditional mutual funds and ETFs in the near future.

This pivot is not driven by a mere trend but by the tangible benefits that DLT offers — enhanced transparency, improved efficiency, and increased security, which are indispensable in today’s fast-paced market.

The Intersection of DeFi and TradFi

As tokenisation matures, it naturally leads to an intriguing convergence with decentralised finance, blending the old with the new. As Adam pointed out, “There’s an emergence of new opportunities around making things from TradFi available in the DeFi world.” This integration is crucial for creating a seamless financial ecosystem that benefits from the transparency and efficiency of DLT while maintaining the robustness of traditional financial systems.

Anna Matson from Northern Trust highlighted the strategic importance of this integration. “We’re of the opinion that traditional markets and digital markets are going to coexist, and many of our clients will look to hold both types,” she said. This dual approach ensures that clients can benefit from the innovations in digital assets while continuing to leverage the stability and familiarity of traditional investments.

Real-World Applications and Integration Challenges

Building on the theme of integration, Ryan Marsh elaborated on the tangible applications and inherent challenges of tokenisation, particularly in improving market efficiency. “We had an extremely productive 2023, delivering use cases in tokenised and programmable money, payments, and trade finance,” he explained.

However, integrating tokenised solutions into existing systems presents significant challenges. “It’s not just integration; it’s simplification as well,” Ryan remarked. The complexity of current financial infrastructures necessitates a careful approach to ensure backward compatibility while leveraging the benefits of new technologies.

From a technological perspective, the lack of standardisation across platforms is a critical issue. Ryan observed, “We need to abstract the complexity away from our customers and make it easy for them to issue new assets, tokenise existing assets, or access assets for custody.”

In our collaborations, especially noted in our work with the Financial Conduct Authority (FCA) and HM Treasury in the UK (as members of the Technology Working Group of the Asset Management Taskforce), we have championed the need for regulatory and operational alignment to facilitate a seamless transition to tokenised solutions. This collaborative approach extends beyond regulatory engagement, involving active participation from asset managers, custodians, and other key stakeholders to ensure that the transition is not only smooth but also sustainable.

Enhancing Investor Experience and Operational Efficiency

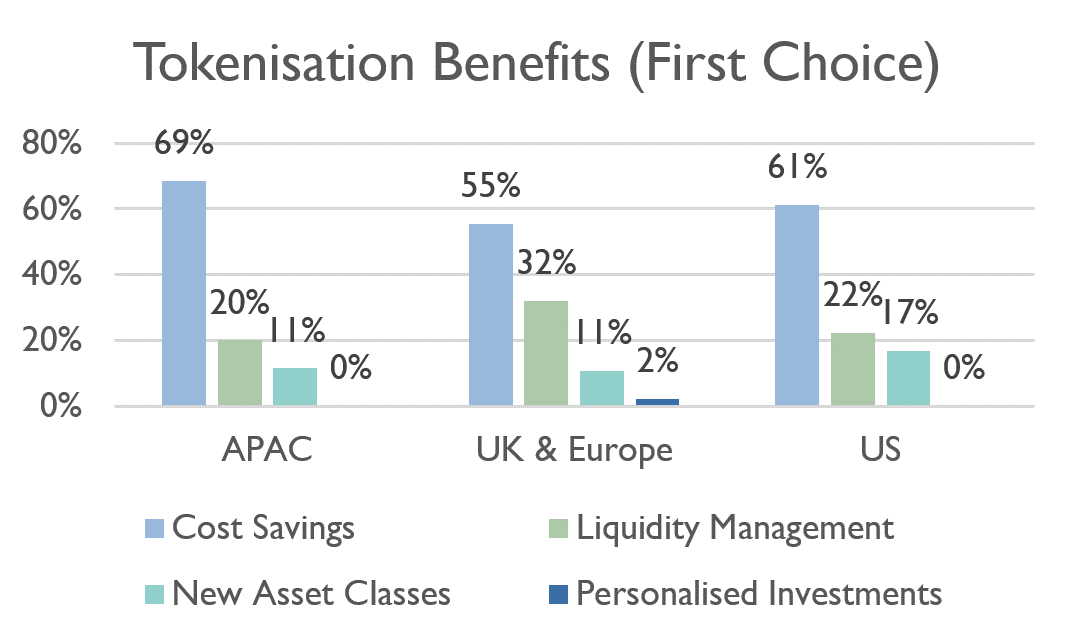

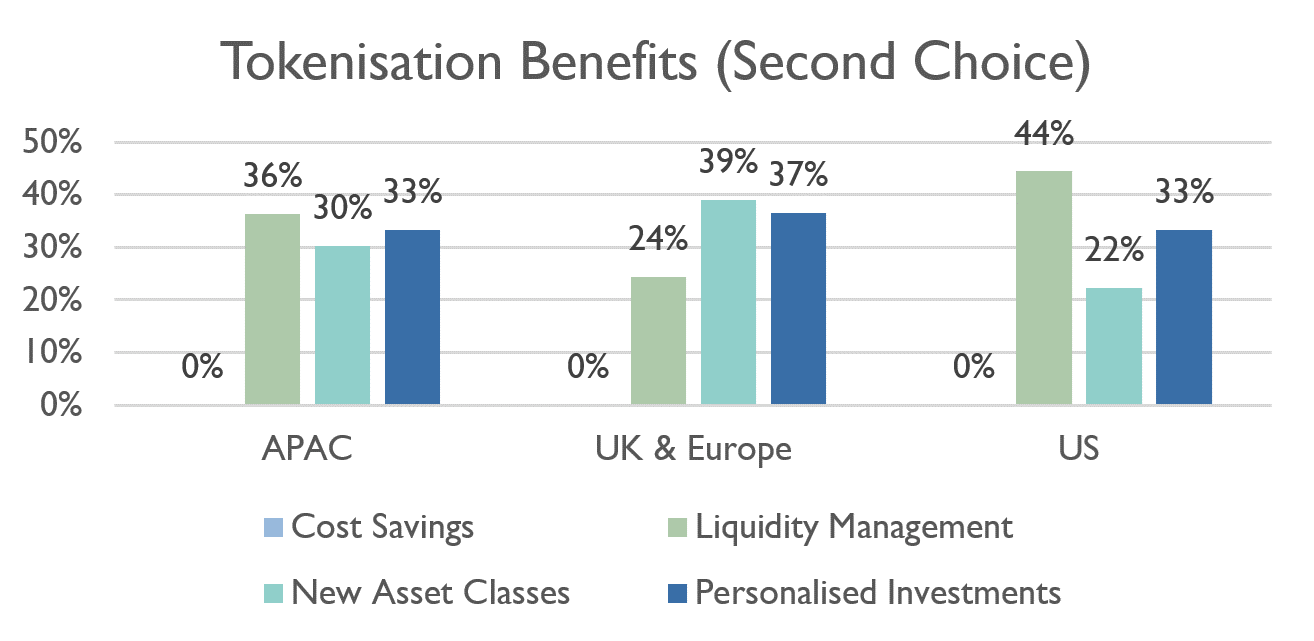

Addressing these integration challenges is not just about overcoming technical hurdles; it’s about enhancing the overall investor experience and operational efficiency, as our panellists highlight. Survey participants cited cost savings, access to new asset classes, improved liquidity management, and greater opportunities for personalisation as the top benefits of tokenisation.

Anna noted, “There’s been a shift from cost as the primary driver for innovation towards more of an investor experience theme.” Adam also emphasized the potential for operational enhancements: “We’ve spent a lot of time, from both an R&D and a product development effort, in that space, because whenever you have these multiple different participants who collaborate to create an investment product and service it and there’s these multiple data sets, all the different books of record, the IBOR, the ABOR and things like that, there’s obviously a use case for DLT.”

Ryan expanded on this, identifying three main trends: efficiency, growth opportunities, and improved product capabilities. “By digitising assets, we can truly digitalise front-to-back processes, adding significant efficiency and potentially changing operating models,” he explained.

Looking Ahead: The Promise of Private Markets

The discussion concluded with a look at the future potential of tokenisation, particularly in private markets. Anna said “Especially around the private markets, that’s where things could move really from use cases into real products. We’re not trying to completely reinvent the wheel per se in the short term – that’s costly and complicated. But looking to those areas like private markets where there is a lack of transparency and high frictional cost.” Ryan also expressed excitement about the transformative potential of blockchain and smart contracts in private markets, which have historically lacked developed electronic infrastructure. “Targeting technologies like blockchain there has the potential to see significant benefits,” he said.

Adam concurred, noting that “private markets suffer from relative inefficiency and various forms of friction.”

Conclusion

The webinar underscored the transformative potential of tokenisation and the significant strides being made in its adoption. As this new piece of research indicates, the momentum is building, and the industry is poised for significant changes. At Calastone, we are excited to be at the forefront of this revolution, leveraging our extensive network and advanced DLT solutions to create a more efficient, transparent, and inclusive financial ecosystem.

The journey is complex, but the rewards are substantial.. As we continue to collaborate with industry leaders, regulators, and our extensive network of financial institutions, we are confident that tokenisation will play a pivotal role in shaping the future of finance.

Please download the full Calastone / Global Custodian research on tokenisation here