With the help of technology, retail investors will be able to access assets previously available only to institutional clients. Bob Currie reports on new research by Funds Europe and Calastone.

Investment advice is likely to remain available to the wealthy and closed off to other people. But assets available to the well-off are likely to become more accessible to non-wealthy clients, too, thanks in large part to technology.

These are two of the main findings in a technology survey of fund professionals conducted by Funds Europe in partnership with Calastone, a funds transaction network with a deep interest in blockchain.

The report, ‘The changing face of fund distribution: technology and innovation in asset management 2020’, is based on an online survey of almost 200 industry professionals located in Europe and the UK. The data collection was managed during January and early February 2020 and concluded before the effects of Covid-19 reached their peak in the survey’s markets.

Investment advice – or at least guidance – lies close to the heart of the shift in asset management from delivering ‘better products’ to ‘better solutions’ instead.

However, the survey reveals concerns that lower-income sections of the investment community will struggle to access suitable investment advice. Alarmingly, 41% of UK-based survey constituents and 53% of those based in continental Europe believe that investment advice will remain the “domain of the wealthy”.

This is a message that asset management companies – and policymakers – must tackle head on if they are to stay true to the objective of extending financial inclusion and providing affordable investment solutions to a wider retail public.

Looking more broadly at the question of investment advice, one respondent indicated that investors will play an increasingly important role in dictating the way that investment advice is constructed and delivered. There will be a transition period, where existing players remain a feature of the landscape, but the industry will need to adapt to the different expectations that millennials and subsequent generations have in terms of how finance and investment advice is delivered.

“There will be a need for flexibility and humility from current market incumbents if they are to survive during these changing times,” says the respondent.

The survey finds that new models for advice provision will be launched across Europe, with robo-advice and the use of model portfolios likely to expand, particularly in the UK market (fig 1).

Meanwhile, another respondent predicted that asset management companies will extend the advisory capability that they can offer from their own investment platforms, particularly as fund companies extend their direct-to-consumer (D2C) sales capability in the UK and Europe. This will be accompanied by “greater vertical integration” in the asset management industry, where fund promoters “widen the range of channels that they employ to acquire investor clients, rather than relying on advice alone”.

Democratising wealth management

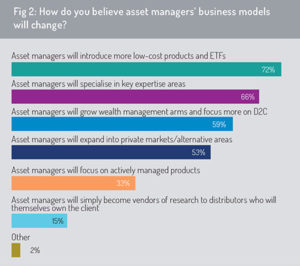

Our survey asked how business models would change, and 72% of survey constituents anticipate that asset managers will introduce more ETFs and low-cost products (fig 2). There is also expected to be a drive towards greater specialisation from asset management companies as they narrow their product range and concentrate product innovation in targeted areas of investment expertise.

One illustration is that some asset management houses may extend their footprint in specialist private market strategies, and more broadly some asset management groups will extend their wealth management arms and enhance their ability to distribute directly to the investor via D2C channels. As one respondent noted, “active management may need to be repackaged by the asset manager to bring themselves closer to the investor – resulting in new forms of ‘advisory sales’”.

Edward Glyn, Calastone’s head of global markets, said there is an obvious coalescence between some of these points. Adoption of new technology is enabling asset management companies to deliver to retail investors the types of investment solution that have, previously, only been available to institutional and high-net-worth investor clients.

“This illustrates the potential that technology offers to democratise wealth management. This will enable asset management companies to extend highly personalised, separately managed account-type solutions to retail investors at ultra-low cost.”

It is in the targeting of this objective where asset managers talk more about solutions than products.

“Investors seek an outcome, not a product,” Glyn says. “Asset managers must deliver the building blocks required to meet these investment goals. It is an open question whether conventional mutual fund products are best suited to meeting these investment outcomes – and we anticipate that, with digitalisation of the investment supply chain, the solutions offered by asset managers will look substantially different to how they look today.”

Glyn believes that the industry does not fully appreciate the potential that distributed ledger technology (DLT) offers to the development of new investment products. This is borne out in survey results, where just 19% of respondents said that adoption of DLT will enable fund companies to launch innovative new fund products – ranking second-lowest in the possible responses they could have selected. By ‘tokenising’ assets on blockchain, this will enable fund promoters to structure new investment products and, potentially, to offer greater trading liquidity by ‘fractionalising’ illiquid assets into smaller denominations that trade as tokens on blockchain.

“The players out in front are those embracing DLT as a springboard for launching new business models,” Glyn adds. “No company ever shrinks its way to greatness and DLT provides an avenue through which companies can move from a product-centric to a solution-centric environment.”

Blockchain disillusionment?

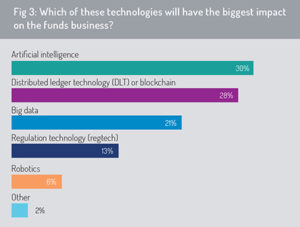

We asked respondents more about the technologies that will most impact asset management. Artificial intelligence and DLT are the areas of tech expected to have the biggest impact.

Respondents identified artificial intelligence (AI) as the emerging technology that will have greatest importance for the industry’s future. (fig 3). DLT (or blockchain) has slipped to second in this list after holding the dominant position for the past three years. However, there is little clear water between these technology types.

The importance of AI, in respondents’ eyes, has strengthened from 22% in 2018 to 30% in 2020, while DLT has weakened from 43% in 2018 to 28% in 2020.

The financial services industry has been slow compared to the logistics, online retail, auto, pharmaceuticals and transportation industries to tap into opportunities offered by AI and machine learning tools. But respondents believe this will change in the coming three to five years, with the asset management sector applying AI to a wider range of use cases, including client service applications, investment research and performance analytics, cyber security and customer segmentation analysis. The industry is also developing a deeper understanding of how it needs to refine its data strategies and data infrastructure to use these AI tools effectively.

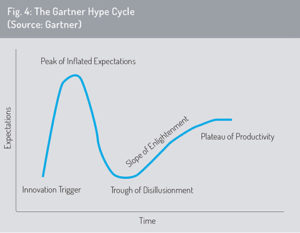

The decline in relative importance of DLT in this survey does not imply that its days are done as a transformative technology. According to Adam Belding, Calastone’s chief technology officer, this reflects a situation where, in Gartner’s “hype cycle” model, blockchain technology is currently going through a “trough of disillusionment”. In this phase, blockchain technologies have not yet lived up to the hype they have received and many blockchain enterprise technology projects are still in experimentation mode.

However, on surviving this trough, Gartner’s model (which provides graphical representation of the maturity of new technologies and their rate of adoption, (see fig 4) predicts that the transformational impact of DLT will again start to rise as it matures as an enterprise technology and a wider range of business cases support its application.

“This aligns with our experience with our Distributed Market Infrastructure (DMI – Calastone’s blockchain-based global funds transaction network),” says Belding. “Some users have been reluctant to go the full distance in applying the benefits offered by a distributed ledger ecosystem. Many are currently utilising DMI in parallel with their existing messaging (e.g. SWIFT 20022 messaging) and technology infrastructures.”

As DLT is better understood as an enterprise technology and benefits from standardisation across blockchain applications, Belding anticipates this will provide a trigger for greater adoption. The IT sector has witnessed similar trends with other initiatives – the transmission control protocol and internet protocol (TCP/IP), for example, which have proved successful at standardising network communication, and HTTP, the hypertext-transfer protocols used to exchange information via webpages.

The ability to handle big data – to process large data sets, to work with high data velocity and with a wide range of data types and formats – underpins much of the innovation taking place now. It is no surprise, therefore, that respondents identify big data in their list of investment priorities – for example, to drive factor-based and quantitative investment strategies, to supply performance measurement and risk-analytics solutions, or as a key input for a wide array of AI strategies. This is a skill that underpins effective delivery in many of the service areas addressed in the survey.

Technology adoption

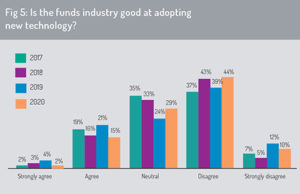

Funds Europe asked whether the asset management industry is good at adopting new technology. The answer, for a fourth consecutive year, is a resounding “no” and in the eyes of our Europe and UK respondents, it is getting slightly worse. Just 17% agreed that the industry is good at adopting new technology, down from 25% in 2019. In contrast, 54% of respondents felt the industry was not good.

Weak understanding of new technology was the most common reason advanced, with lack of a compelling business case for adoption also a significant constraint. More than two-fifths of respondents indicated that they do not have the appropriate in-house skills to support their technology strategies, although this perceived skills gap has contracted slightly over the past 12 months.

However, a large majority of respondents are aware of the growing importance technology will have to business performance. Fewer than 10% of respondents said that they have no requirement to adopt new technology. The need for technology upgrades, and enhancements to their digital strategies, is clearly pressing.

Disruptors and service partners

On the question of which types of company pose the greatest threat to asset managers in terms of their existing business, survey respondents told us that the dominant threat will come from online retailers (e.g. Alibaba, Amazon) and technology companies (e.g. Google, Microsoft, Apple).

At least two conclusions are significant here. One potential threat to asset management companies is through commercial competition, resulting in the loss of sales opportunities and revenue to competitor organisations.

A second threat involves stability and resilience concerns – particularly relating to the systemic importance of BigTech companies in providing essential services such as cloud-based data management and “as-a-service”-type delivery options (such as infrastructure-as-a-service, platform-as-a-service and software-as-a-service).

The Financial Stability Board published a paper in December 2019 focusing on the role of large technology firms in financial services (FSB, ‘BigTech in finance: market developments and potential financial stability implications’, 9 December 2019). This highlighted the FSB’s growing concerns around systemic risk and a ‘too big to fail” problem – the risk that certain BigTech firms (and potentially online retailers such as Alibaba, which offer both financial and technology services) are so integral to the secure functioning of the financial infrastructure that their failure would be a big threat to financial continuity.

Having tightened oversight of ‘G-SIFIs’ – global systemically important financial institutions – in the wake of the global financial crisis, regulators are now focusing their attention on what might be classed ‘global systemically important technology organisations’ (although the FSB does not use that terminology).

A point of concern for financial authorities is that a small number of technology firms (and/or online retailers) may come to dominate, rather than to diversify, financial services provision in some jurisdictions. The widespread access that these firms have to customers’ purchasing histories and lifestyle data is likely to reinforce this trend. In this situation, the failure of one of these firms could lead to major disruption in the financial services industry.

Also, this raises fundamental questions around regulatory equivalence. Financial supervisors must ensure that the licensing, risk management and control procedures applied to technology firms and online retailers is of an equivalent standard to those required of regulated financial institutions when they are delivering similar financial products and services.

Expanding on the survey findings, Calastone’s Glyn believes that the primary sources of disruption will come from the incumbent players in the existing supply chain, who are likely to disrupt themselves, as well as new competitors stepping into this market. Asset management companies will extend their presence in the D2C space, as the survey results confirm. On the distributor side, a number of mega-distributors take the view that fund promoters will become little more than vendors of research. Consequently, these distributors will seek to deliver better outcomes for their investor clients at lower cost by meeting part of this solutions manufacturing requirement in-house.

The result is an environment where fund promoters, fund distributors and asset servicing companies (who may themselves be exploring the launch of fund platforms) are looking to extend their footprint into new areas of the transaction value chain and to compete even more fiercely with each other for the basis points on offer.

While disruption may come primarily from existing incumbents in the supply chain, Adam Belding says that technology firms and online retailers are likely to play an important role in this process. For example, BlackRock has announced a strategic partnership with Microsoft to host Aladdin on Azure, Microsoft’s cloud-computing platform. BigTech firms and large online retailers have captured a large market share in their traditional service areas and may explore opportunities further up the value chain to extend their revenue stream. One of the most lucrative opportunities lies in helping people to manage their money. Consequently, further partnerships between technology and financial services firms are likely in the future.

In keeping with this prognosis, online retailers such as Alibaba are establishing high-profile alliances with financial services companies, including asset managers. For example, Atlanta-based asset manager Invesco reported significant growth in assets under management following an alliance with Alibaba, signed in 2018, through which the Invesco Great Wall Jingyi Money Market Fund became one of a small number of money market funds to be hosted on Ant Financial’s wealth management platform.

More generally, Alibaba and Ant Financial have established strategic alliances with partners across the financial services sector – including fund management, banking, insurance and fintech – some of which have been in place for many years. In December 2019, for instance, Alibaba and Ant Financial entered into a strategic partnership with the Industrial and Commercial Bank of China (ICBC) to enhance cooperation in fintech and financial services. However, there has been active project collaboration between these two companies since 2005, when ICBC and Alipay first announced a partnership to deliver online payments in the Chinese market

(First published in Funds Europe 20/05/20: https://www.funds-europe.com/may-2020/technology-tech-will-democratise-wealth-management)