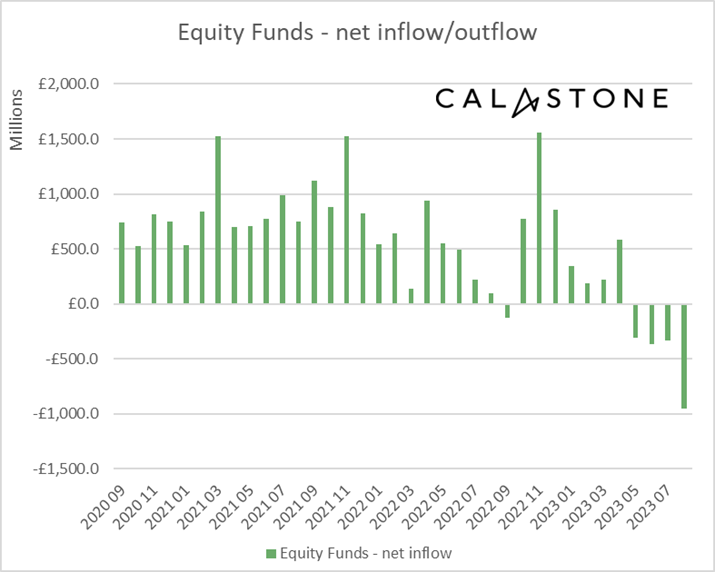

Investors ran scared in August selling down both equity and fixed income fund holdings, according to the latest Fund Flow Index from Calastone, the largest global funds network. Outflows from equity funds reached their highest level since September 2022, while fixed income funds suffered their first outflows since June last year. Property and mixed asset funds were also hit with further net selling. Meanwhile, investors added near-record capital to safe-haven money market funds that are offering the best income since before the Global Financial Crisis.

Global stock markets peaked at the very end of July 2023, not far below the all-time high they reached near the end of 2021[1], before losing around 6% through the first half of August. The global index ended the month down just under 3%.

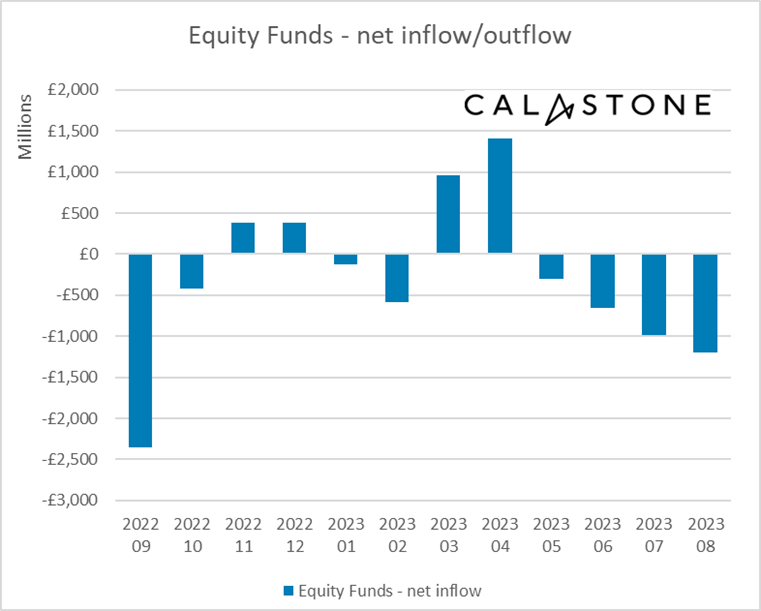

Equity funds saw largest outflows since September 2022 and 7th worst month on record

Investors reacted strongly to the falling market(s). Equity fund outflows hit £1.19bn in August, their highest since September last year, and marking the seventh worst month for equity fund outflows on Calastone’s nine-year record. Outflows were concentrated in the first half of the month when markets were at their weakest, but there was little concerted buying even as markets began to recover.

UK-focused funds hardest hit, but most equity categories suffered outflows

UK-focused equity funds were hardest hit, with redemptions of £811m, the highest since February and one of their seven worst months on record; August was the 27th consecutive month in which investors have withdrawn capital from UK-focused funds. Meanwhile US equity funds had their second-worst ever month with outflows of £620m, taking the total net selling to £3.05bn in the last 12 months[2]. Outflows have accelerated in the last four months as the US market rose to its end-July peak. Elsewhere, income funds had their fifth worst month on record with outflows of £632m, while European, Asia-Pacific, country and sector funds all saw outflows.

ESG boom ends – ESG equity funds saw record outflows of £953m

August was also a very weak month for ESG equity funds – investors sold down a net £953m of ESG equity funds, the fourth consecutive month of outflows and taking the total to withdrawn since May to £1.96bn. Before 2023, only one month had seen outflows since the ESG boom began in early 2019.

Investor focus on global funds intensifies

The big winners were global equity funds, which absorbed £1.18bn as part of an intensifying trend in favour of funds with a global mandate, and emerging markets (+£180m). These two sectors have been the only two categories of equity funds to see inflows in 2023 (£9.00bn and £2.11bn year-to-date respectively).

August’s bond market turbulence caused first outflows since June 2022

Fixed income funds also had a very weak month. Investors hoping interest rates have peaked have added steadily to bond funds this year (£4.78bn between January and July). But markets have confounded these hopes – yields have been rising (and prices falling) ever since April as economies have proven resilient and core inflation resistant to higher rates. The surge in bond yields in the first half of August (itself the cause of the equity market correction) pushed bond prices down and investors out of fixed income funds. They sold a net £330m of their holdings in August, with a significant proportion of this coming from index-linked funds which are the most sensitive to higher long-term interest rates. Outflows from bond funds slowed markedly in the last few days of the month as weaker economic news caused market yields to subside again (and bond prices to rise).

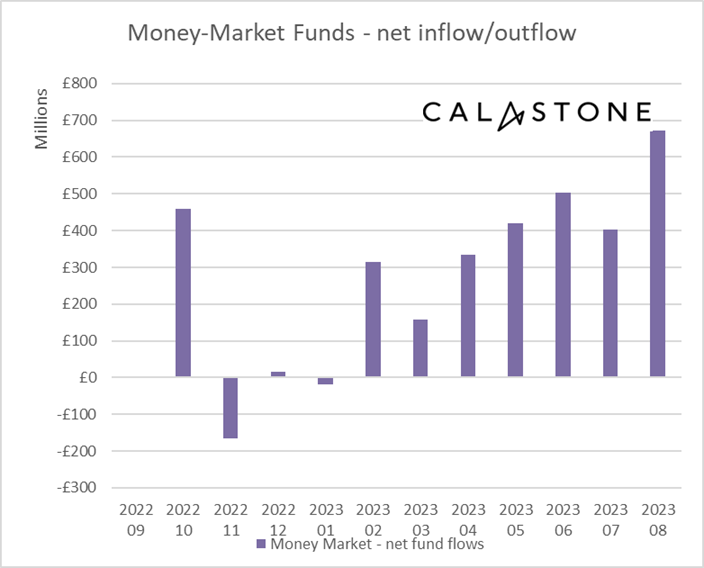

Money market funds added £673m – second highest inflows on record

Money market funds were the biggest beneficiaries of investor risk-aversion in August. Investors added £673m to their holdings, by far the strongest inflow since the immediate onset of the pandemic in March 2020[3] and the second highest on record.

Edward Glyn, head of global markets at Calastone said: “Fear was a big motivator in August. Discouraging economic data in the UK showed core inflation has proven resistant to rate hikes, while the US economy has shown signs of accelerating in recent weeks – expectations of yet more rate hikes are bad news for asset prices. Bond yields pushed higher as a result, dragging stock markets and bond prices lower. This had investors running for the safety of cash and money-market funds. With savings interest rates and yields on safe-haven money market funds at their highest level since 2007, it doesn’t take much to cause a rout.

“Tepid economic data in the second half of the month boosted hopes that central banks may begin to lower interest rates sooner rather than later after all, and that has driven the market rally. But it’s not been enough to tempt fund investors back into to riskier assets. A clearer prognosis from central banks this month would help investors set their direction for the next few months.

Edward Glyn added a final word on income and ESG funds: “Income fund outflows reflect a double whammy. Firstly, higher savings interest rates make equity yields look less favourable by comparison – equities are higher risk than cash and although they offer the prospect of long-term income growth, investors are clearly more focused on risk just now. The sector is also heavily UK focused and with UK assets so out of favour, income funds are suffering the anti-UK bias that has become heavily entrenched in investor psychology over the last few years.

“The move out of ESG funds has gathered pace in a remarkable reversal after the boom in recent years. Four months of outflows signals a new trend emerging that fund houses will have to work hard to counteract. ESG funds are mainly actively managed, so they have offered a helpful bulwark against the rise of index funds. With ESG now tracking backwards, index funds are once again beating their active counterparts for new capital[4].”

[1] MSCI International ACWI index: record high 31/10/21 757; 31/7/23 index reached 706

[2] Year-to-date -£2.27bn

[3] March 2020: £828m

[4] See appendix tables