Automation is nothing new when it comes to fund management. For decades, fund managers and asset servicers have been looking to technology to help grow their businesses and margins and improve the overall experience for end-investors.

However, due to the way the mutual fund industry has grown, this automation has nearly always taken place in isolation. Different markets grew at different times and different speeds, resulting in varying automation, not just across different countries but across different asset managers within that same country as individual firms automated in siloes. The tendency was to tweak legacy infrastructure rather than overhaul it.

A century’s worth of different systems and processes has resulted in a complex and fragmented landscape, with manual processes and antiquated technology like fax machines remaining the backbone of many asset managers’ operations.

In recent years, however, the world of fund management has entered a new era. Numerous new technologies have arrived, with microservices, APIs and distributed ledger technology

(DLT) allowing funds to become more intelligent and efficient and move away from their cumbersome legacy systems. At the same time, firms like Calastone have emerged to connect formerly siloed asset managers with each other.

For asset managers that take advantage of this, there is a clear competitive advantage. Managers in the US classed as ‘digital leaders’ were able to onboard new institutional clients more than twice as fast and at a quarter of the cost, their ten-year AUM growth rate was double the industry average, and their profit margin 70% higher, according to a McKinsey study[1].

With that advantage in mind, this survey aims to take stock of the start of that new era. It examines not just how automated the industry is, but how automated it perceives itself to be, and asks how that differs by country, company and manager type and the driving forces within those groups

[1] 24 P. Baghai, R. Bector et al., “Achieving digital alpha in asset management”, McKinsey, November 9th 2018.

For this survey, we spoke to nearly 600 respondents from across the globe, from both mature and emerging markets. The respondents were mutual fund investment managers, both those who largely outsource their operations and those that largely manage them in-house, and mutual fund asset servicers or administrators.

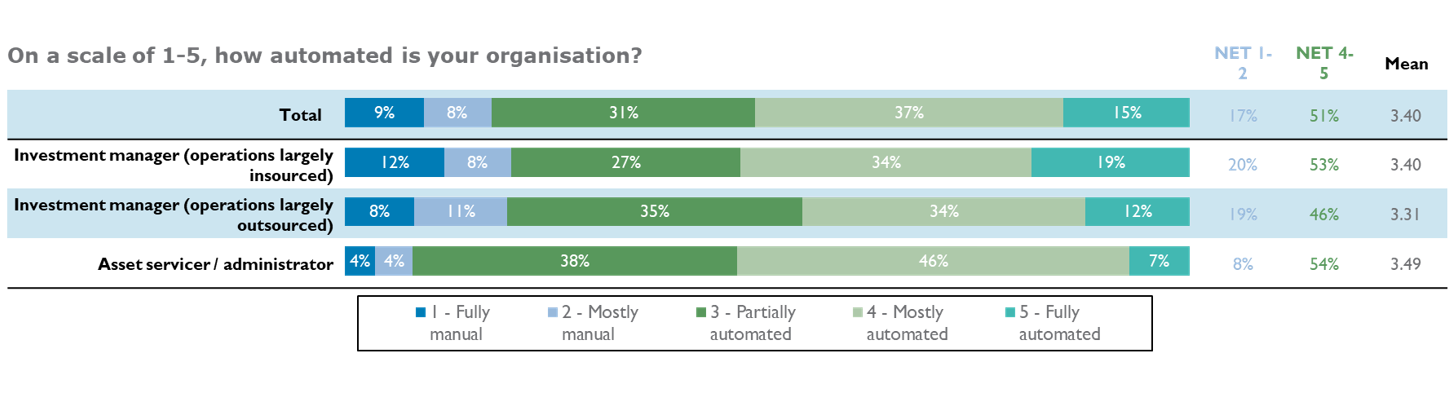

When asked how automated they believe their organisations to be, over half (52%) of the respondents consider their organisations to be ‘mostly’ or ‘fully’ automated, with 31% considering themselves ‘partially automated’. However, 17% of our respondents described their companies as still either ‘fully’ (9%) or ‘mostly’ (8%) manual.

Analysing those numbers via business type, asset servicers are less likely to be manual than investment managers. This makes sense when considering the administrative nature of the processes they’re responsible for and their main role. That is, to remove complexity and streamline processes for fund managers. By removing manual processes when it comes to processing trades, onboarding investor accounts and reconciling cash flows, servicers can save themselves and the managers they serve huge amounts of time and cost.

This focus on automating administration is further reflected in the fact that order management and clearing and settlement are the areas most likely to be automated.

There’s likely also an element of companies seeing administrative tasks as a quick automation win, in comparison to more complex automation tools such as artificial intelligence (AI), machine learning (ML), DLT and tokenisation.

In contrast, client account opening, a task which often requires a greater degree of insight – and an area in which ML is starting to be used already – is most likely to be manual. Overall, however, progress is being made across businesses, with at least half of organisations claiming to be ‘mostly’ or ‘fully’ automated across all areas.

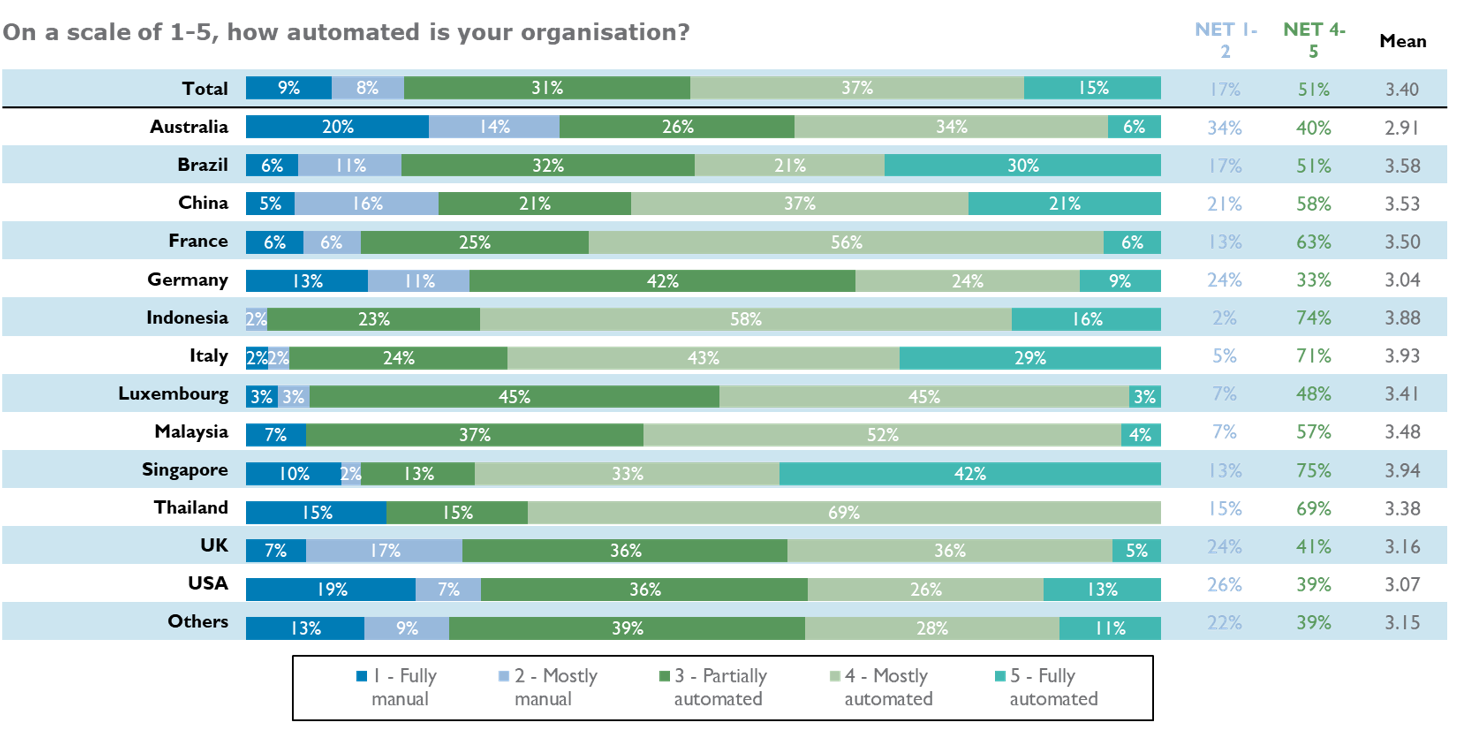

Breaking those numbers down country by country, it’s organisations based in Singapore, Indonesia, Brazil, Thailand and Italy that are more likely to consider themselves ‘mostly’ or ‘fully’ automated. While organisations based in Australia, the US, UK and Germany are the least likely to consider themselves ‘mostly’ or ‘fully’ automated, and the most likely to be ‘manual’.

There are likely a few factors at play here.

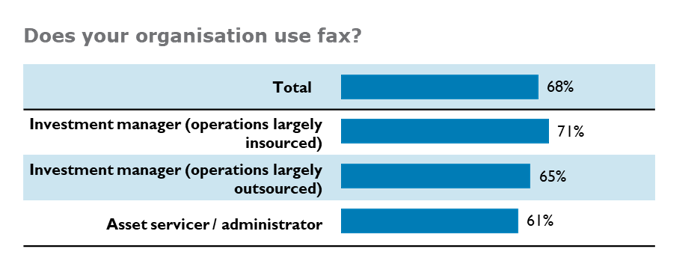

The aforementioned legacy systems in older markets such as the US and UK make automation a much harder and costlier task, and the established nature of the big players can act as a blocker for disruption and competition, as proven by the rather worrying finding that around three quarters of organisations in the US, France and Germany still rely on fax. In addition, the sheer size of these markets, the US in particular, make it particularly hard for new innovations to become commonplace.

In emerging markets, the reverse is true. With fewer established funds monopolising the market, there’s more room for the competition to innovate and leapfrog with nimble, modern systems.

The internationalisation of markets will also have an impact. Respondents from Italy and Brazil are some of the most likely to consider themselves mostly or fully automated and have relatively low fax usage. Both are predominantly domestic funds markets and therefore have an easier job in automating compared to cross-border markets like Luxembourg.

There’s an element of perception here too. In many instances, respondents across Asia considered themselves more automated than their European counterparts, yet the use of fax – a tool many in Europe would consider outdated and irrelevant – is far more prevalent in Asia.

Worryingly, 68% of our respondents still use fax. The only regions where usage was below half were Brazil and Thailand. By some margin, we found that fax use is highest among investment managers that insource operations. It suggests that firms need to look beyond themselves to external partners to help drive their digital transformation.

For managers and servicers operating in those fax-heavy markets, shifting towards a more modern means of communication presents a quick automation win and provides a clear opportunity to carve out a competitive advantage. Those that move to digital alternatives provided by tech such as open APIs and cloud transfers can process more trades –only a certain number can go via a fax’s phone line at any given time– and significantly reduce the time spent and errors made by manually inputting orders.

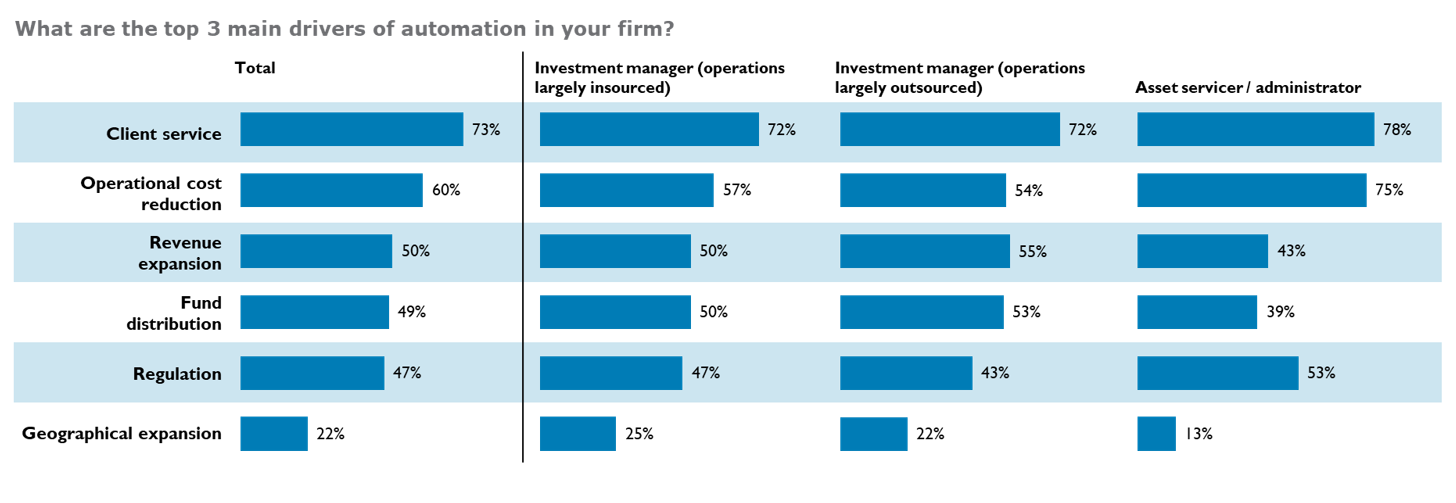

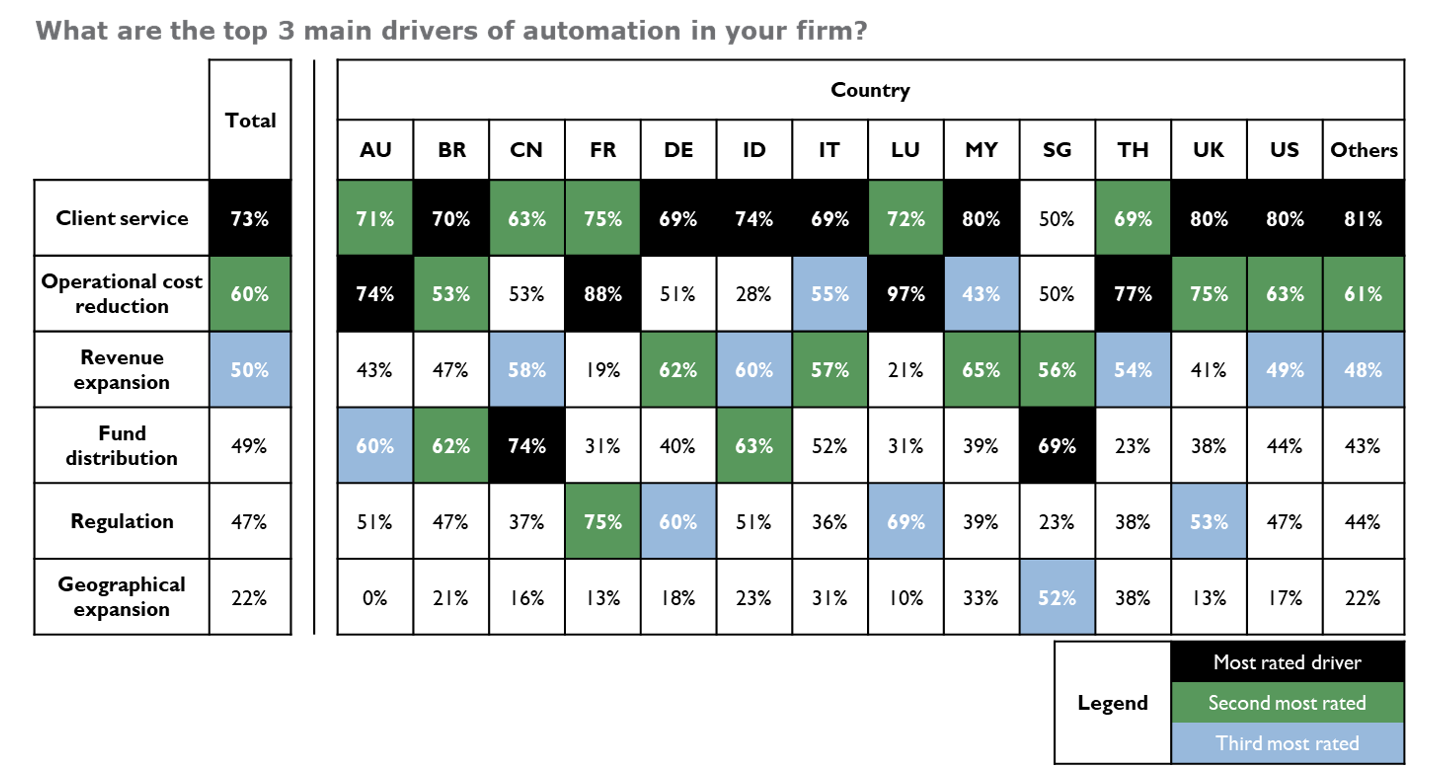

Across all business types and in nearly every country, client service was the main driver for automation. This not only reflects the ultimate goal of automation, that is, the improvement in results and experience for clients, but also reflects that managers and the industry as a whole are aware of the gulf between the client experience in fund management and day-to-day consumer experience. The automation, personalisation and speed of modern ecommerce, share dealing apps and digital banks is conspicuously absent from asset managers’ client-related services.

Although client service ranked higher than any other factor across all countries, it ranked highest of all in the US. One reason for this may be that the US has a highly competitive retail investment market as well as a general ‘service culture’.

The ongoing global economic situation is reflected in the number of companies focussing on cost reduction via automation.

Asset servicers and administrators are more driven by reducing costs than investment managers. This isn’t surprising considering the administrative nature of the businesses and their business models and the fact that they have considerably lower margins than asset managers.

Geographically, cost reduction is ranked extremely high in Luxembourg, with 97% of organisations listing it as a driver. As a large market with a high volume of daily transactions, a high proportion of service providers, and notoriously high labour and business costs, the impact of manual processes is more keenly felt.

At the other end of the spectrum is Indonesia where just 28% of respondents listed it as a driver. It may be that less volume, lower labour costs and a strong tradition of manual processes mean cost is less of an issue here, but , 77% of organisations headquartered in Thailand, a similarly sized fund market with equally low labour costs, listed cost reduction as an automation driver, bucking the trend.

Overall, geographical expansion was a fairly low driver. In fact, there were only three countries where more than 30% of organisations listed it: Italy (31%), Thailand (38%) and Singapore (52%).

Cross-border distribution is growing fast in Thailand and Singapore. Consequently, more automation will be needed to facilitate that cross-border flow and to provide the kind of processing efficiency that global players will expect.

As we’ve mentioned, the Italian funds market is predominantly domestic, so expanding globally is an understandable priority. As one of the most automated nations in our survey, this relatively new market – mutual funds were only recognised in 1983 – could be in a great position to do so.

In recent years, a number of new regulations have emerged with the aim of bettering investor and consumer outcomes. These have been particularly prominent in the EU and UK, with many organisations headquartered in those locations listing regulations as a driver of automation. The 2018 Markets in Financial Instruments Directive 2 (MiFiD II) and 2021’s Sustainable Finance Disclosure Regulation (SFDR) were listed as the leading regulatory drivers, along with general anti-money laundering regulations.

Although British companies are no longer required to meet EU regulations, they are bound by a substantially similar regulatory regime that was put in place after the country left the EU.

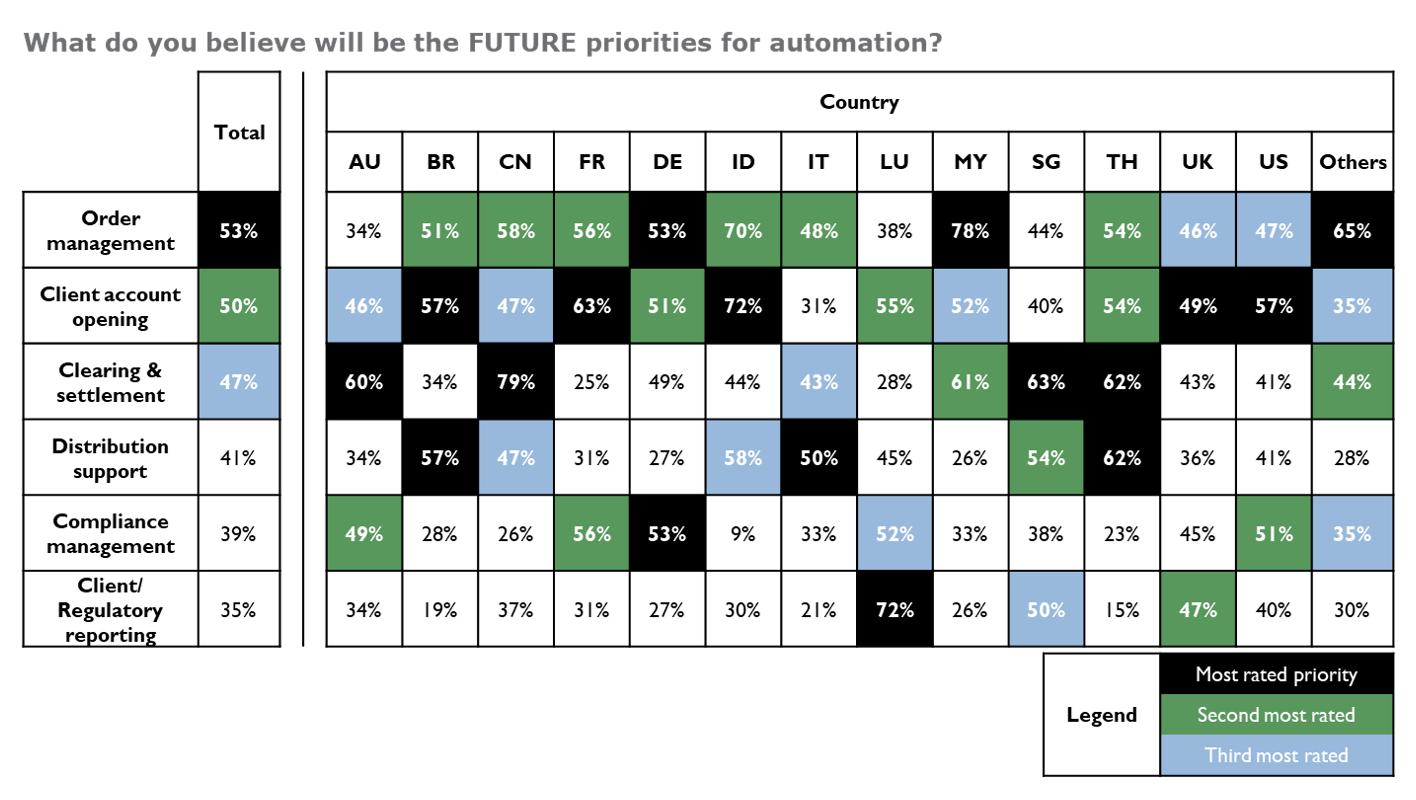

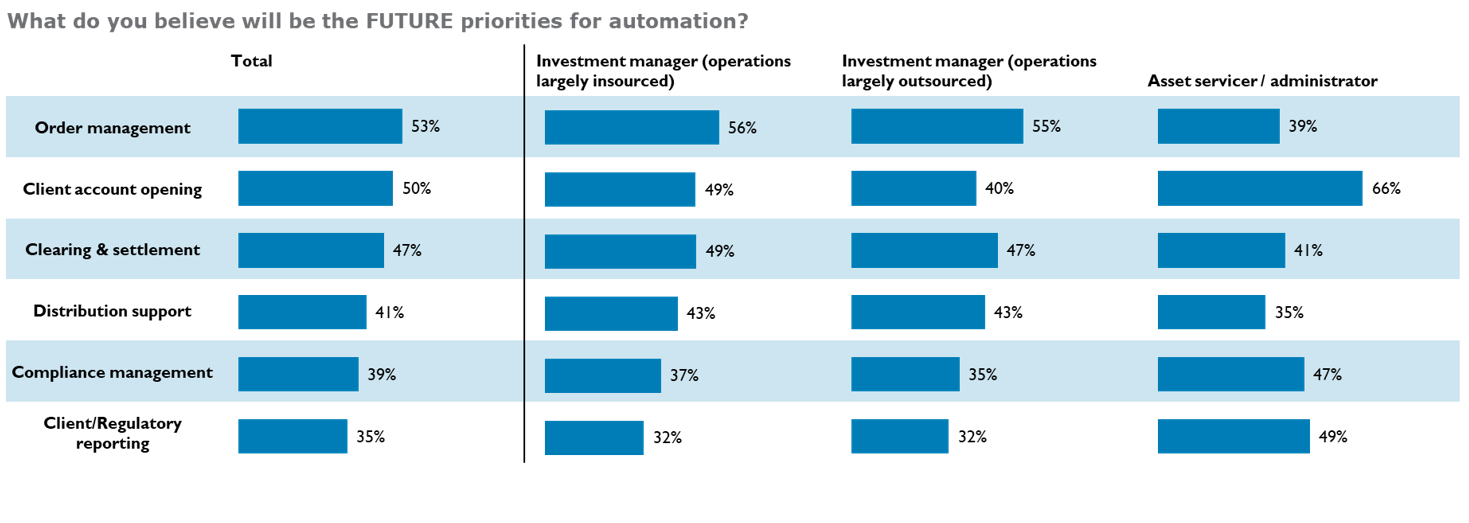

This is a defining moment for the fund management industry. For managers and servicers alike, automation has reached a level of sophistication where maintaining manual processes can put them at a significant competitive disadvantage. Automating an entire operation, however, is easier said than done. Firms must prioritise. Therefore, we asked our respondents their priorities for the future. Their answers give a snapshot of where they are now, and which businesses and countries understand how to gain the advantage in the coming years.

Australian organisations, for example, are prioritising settlements, an area in which they have lagged behind in the past, especially in comparison to their market-leading approach to order routing automation. However, despite low levels of STP when it comes to transfers, just 34% of Australian firms are prioritising overall fund distribution.

It’s a similar story in the UK. British organisations are poor on STP transfers (just 46%), yet fund distribution isn’t even a top three priority for UK organisations. By not addressing this, investors will continue to be negatively affected.

Looking at the wider picture, less developed and emerging markets such as Thailand, Singapore and Malaysia are prioritising ‘the basics’ such as orders and settlements. Established markets, meanwhile, which have already done that legwork, are looking at account opening.

From a business by business perspective, asset servicers are the outlier. Their priorities are regulation, compliance and account opening. Investment managers, on the other hand, are prioritising order management and clearing and settlement. Between the two manager groups, their priorities are almost identical, except when it comes to client account opening, where investment managers that insource their operations are prioritising the automation of account opening far more than their outsourcing counterparts.

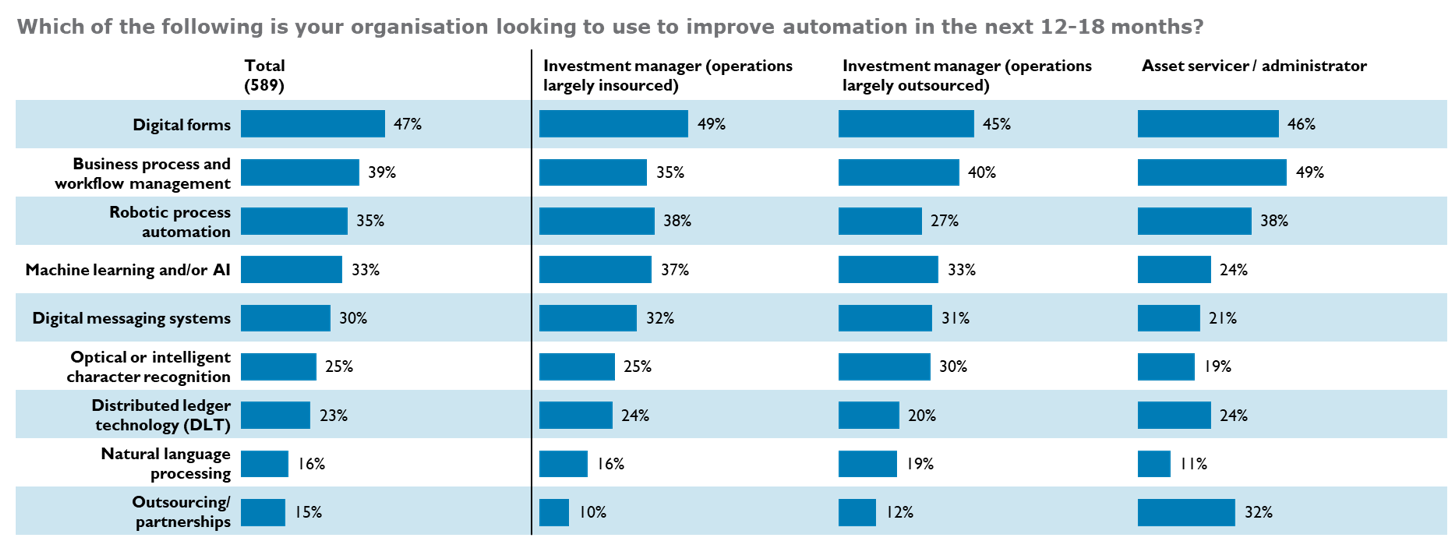

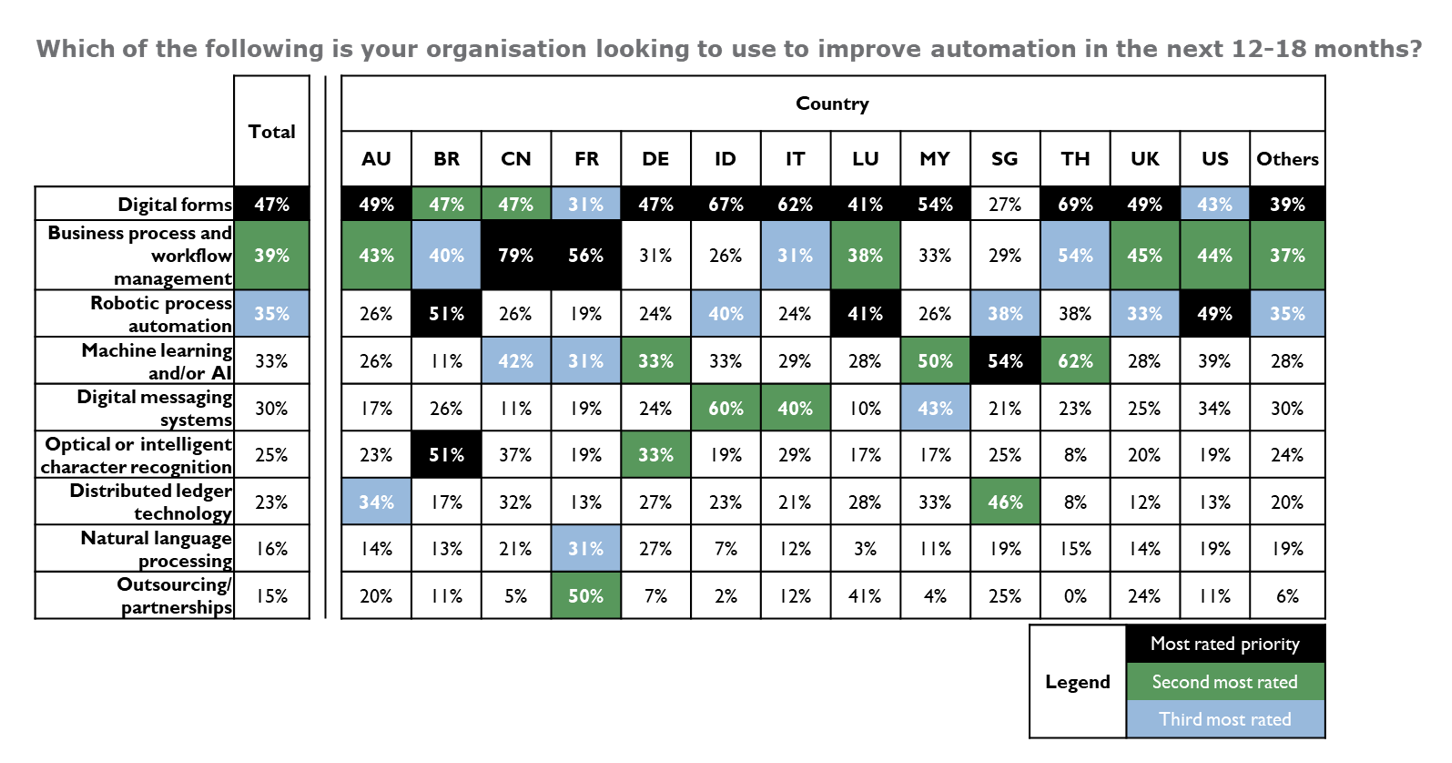

Asking our respondents what types of automation they were looking to adopt over the coming 12-18 months, the overwhelming focus across the board was automating largely manual processes. Digital forms were a particular priority, highlighting the industry’s understanding of the value in automating simple but time-consuming tasks in the name of efficiency.

The other tool of choice was robotic process automation, which was popular all round but particularly so among the more admin-heavy workplaces of asset servicers and investment managers with in-house operations.

This efficiency-via-automation approach is the focus of many of the mature markets. Luxemburg, the UK and the US, for example, are all looking at the two technologies mentioned above along with business process and workflow management. Understandable considering the size of those markets, the daily number of the trades and the admin associated with that.

The outlier, however, is Brazilian organisations, which are more likely to be considering robotic process automation and optical or intelligent character recognition, than organisations headquartered anywhere else.

However, as impactful as automating these manual processes could be, it could be argued these tools are essentially sticking plasters for existing analogue workflows. After all, optical character recognition still indicates a high prevalence of fax and paper use.

This stands in marked contrast to firms in Malaysia, Singapore and Australia, who, as well as looking at automating manual tasks, are putting more energy into truly transformative technologies such as DLT, one of the key technologies being looked at by organisations in Malaysia, Singapore and Australia. In Singapore in particular, there is a lot of DLT-related activity and a rapidly growing tokenisation market, boosted further by advances in AI and ML. The local regulator, Monetary Authority of Singapore (MAS), is also heavily involved in these projects and has worked hard to push asset managers to use the latest technology to improve investor outcomes. In addition to approving a number of digital asset offerings, MAS has also launched its own initiative – Project Guardian – to explore the potential of tokenised financial assets.

Our report finds an industry that is making huge, innovative strides – but one with a long way to go. An industry with one foot firmly in the future and the other in the past. Where 68% of organisations are still using fax machines, and yet many are looking to leverage the latest technologies to enhance their automation journeys. One where entirely manual businesses operate alongside firms built around transformative technologies such as DLT, ML and AI. One where those two approaches are used alongside each other in the same business.

All of which suggests there is still a huge competitive advantage to be carved out by those who pursue further automation.

Across the organisations we spoke to, wherever they are in the world, there seemed to be an understanding that this starts by automating those manual processes. For the newest markets, that means focussing on the basics and building their businesses on automated foundations, helping them to avoid many of the issues that have held back some incumbent businesses and markets from genuine digital transformation.

But for the businesses that have those basics in place, it’s a case of investing and going full steam ahead with more transformative, long-term technologies. And for the markets that are already using those technologies, the priority must be stamping out any manual processes to become fully automated.

In this new era of fund management, convenience, immediacy and personalisation will be at the forefront of the investor experience and manual processes will not be acceptable to many – especially with a new generation of tech-first investors entering the space. The same technologies that help fund managers and asset servicers to run a more profitable and global business can also enable them to deliver a better, more personalised and responsive service for end-investors.

There remains a lot of low-hanging fruit in automation, but also numerous opportunities for those shooting for a complete digital transformation. Those firms that can focus on both will not only be better prepared to weather the storms of 2023 but able to surge ahead of their competitors while doing so.

By joining the Calastone network, clients are seamlessly connected to the world’s largest community of funds, giving access to funds worldwide through a robust and digital network, ensuring that the fund trading process becomes faster, risk-free and lower in cost. Contact us to find out more.