The millennial generation have transformed how the world socialises, works and purchases services. Now that the generation has matured, with the older members of this segment approaching their middle age, they have started looking for ways to save their disposable income and accumulate their assets over the long-term. This could make them an ideal target market for investment firms, however it’s also a group the industry has struggled to develop a meaningful rapport with. If asset managers and distributors are to diversify their revenue streams and future-proof their client bases, they need to better understand what motivates them.

To help the industry gain a greater understanding of this increasingly important demographic, we undertook a global study looking into the approaches and attitudes of millennials towards saving and investing.

Understanding millennials

One of the first key learnings from the study we found was that it’s crucial the industry does more to educate younger people in Europe about the benefits of investing and saving. One third, for example, told us that they lacked the knowledge to invest. This issue is particularly prominent in the UK, where 42% said they wouldn’t know where to start. This knowledge gap must be addressed.

Furthermore, our study showed that just a quarter of millennials in some European countries have any interest in finance and investing, versus nearly half in the US. Most instead prioritise travelling, social media, video games, and sport rather than focussing on their long-term future.

Millennials and money management

We found that less than two thirds of millennials in Europe save on a monthly basis, a figure that is dwarfed by respondents in Hong Kong for example, nearly all of whom told us that they put aside money each month.

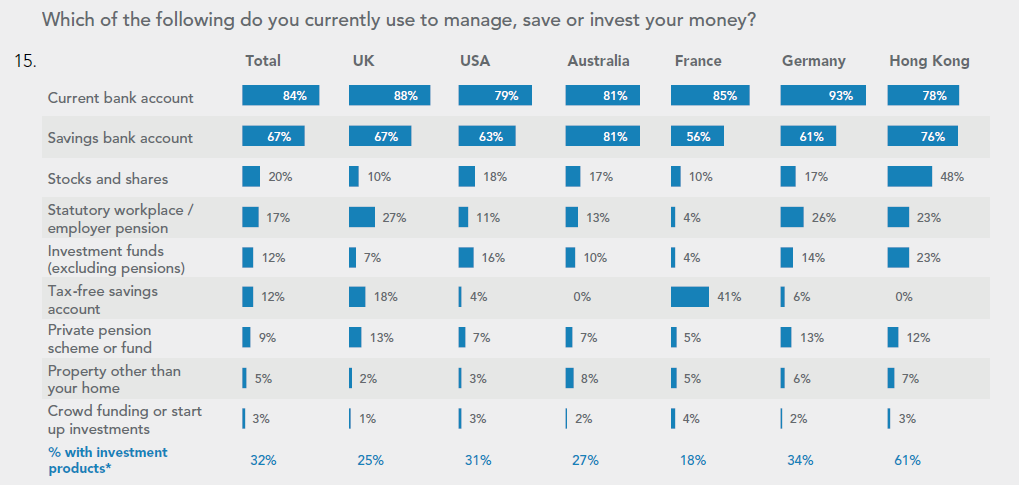

Those millennials in Europe who said they did not save admitted it was because they couldn’t afford to. Those that do have savings simply keep them in a bank account, very few use investment products. Only 25% of young people in the UK do so, dropping to just 18% in France, in contrast to well over half millennials in Hong Kong. Because the amount of savings in Europe is so small, they’re struggling more to access funds than those in Hong Kong, because they can’t get past the minimum investment thresholds.

European fund businesses need to consider how they can attract and service this group of investors given their lower levels of investable cash. One solution could be to enable large scale micro-investing, ensuring that investors can get past these minimum investment thresholds.

Despite funds being relatively inaccessible today, most European millennials stated that they are likely to invest their money in the future. For example, just over half French and German respondents respectively said they would like to start investing soon. Australians and Americans, however, were found to be much more likely to be keen to invest.The UK was the exception with two thirds stating they would like to start investing in the future.

Investment funds: what matters to millennials?

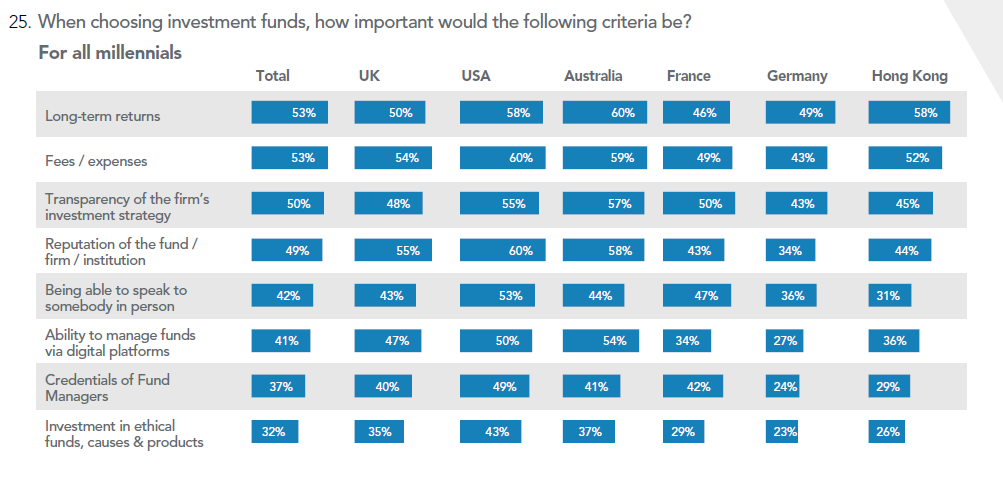

When choosing investment funds the needs of millennials across the world don’t differ particularly from any other generation with most identifying returns, fees and transparency as the most important criteria. For those that already actively invest, the importance of strong long-term returns becomes even greater.

For most millennials we found that digital access and ethical considerations were rated much lower down than the core fundamentals for investing. Interestingly millennials also stated that when managing their investments, being able to access people and speak to them directly was rated as highly. These findings indicate something that perhaps much of the funds industry is not that aware of, with a significant amount of focus being placed on ethics and digital.

A key point is that once millennials do start to invest, and become familiar with the process, they become much more open to managing investments digitally and feel to a greater extent that, when choosing investments funds, digital access is important.

After fees and transparency, we found that trust is also particularly high on the agenda for most millennials, with the reputation of the fund managers being identified as very important. This element was rated to be particularly important in UK and outside of Europe, but less so in the rest of Europe.

The key to trust…

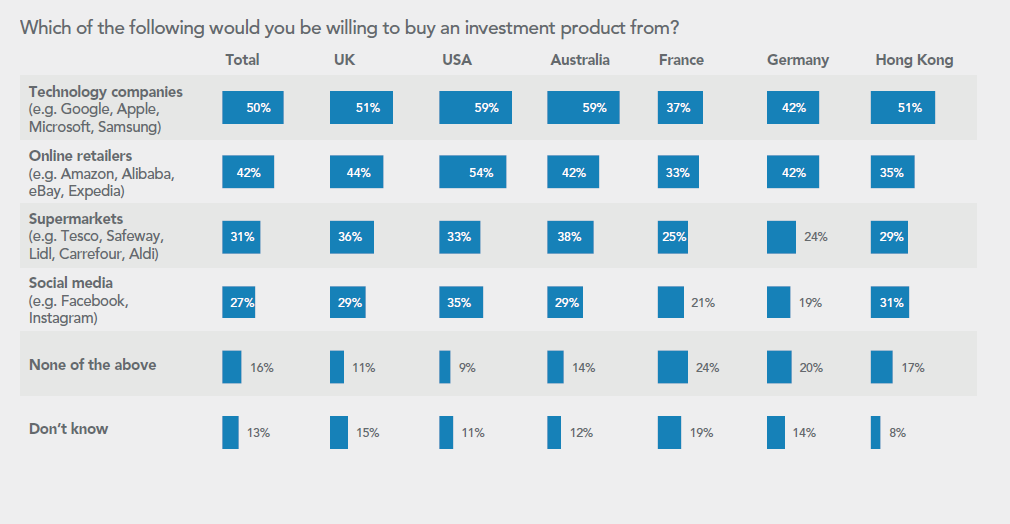

Whoever can win the trust of millennials will be the winner of the future. However where millennials place trust may not be just as simple as long-term loyalty or fund manager credentials. We found that many millennials would place their trust in big tech companies to manage their investments if given the opportunity. We are seeing a growing trend of millennials demonstrating a significant degree of trust in non-traditional players, such as Google and Apple. Over half of US and Australian millennials said they would be happy to invest in funds through companies like this. While fewer millennials in most of Europe had yet to be fully convinced by the merits of investing via technology companies, young people who already invest are more receptive to the idea.

This level of trust in big tech is something that the funds industry must be mindful of, as the likelihood of them entering the space is higher than it may initially seem. The fact that millennials without a real understanding of investing or finance would place their trust in these companies with no strong track record in financial services indicates the scale of the problem that the future industry may face.

Closing the knowledge gap and attracting millennials

What our study has shown us is that millennials in Europe, relative to the rest of the world, suffer from a significant gap in knowledge and interest in finance and investments. If the funds industry is to remain relevant in this region, this must be addressed. Gaining the trust of millennials will also be key. Not just to open the opportunity to educate this demographic on the importance of investing their money, but to alleviate the potential threat of the big tech companies.

To fully achieve success, the funds industry must focus on providing low cost products with smaller investment thresholds, which could be made possible through distributed ledger technology, for example. This is especially important when we consider that high returns and low fees are at the top of their agenda. It is through innovations such as DLT that the industry will be able to finally benefit this generation and help them achieve their long terms goals and aspirations.