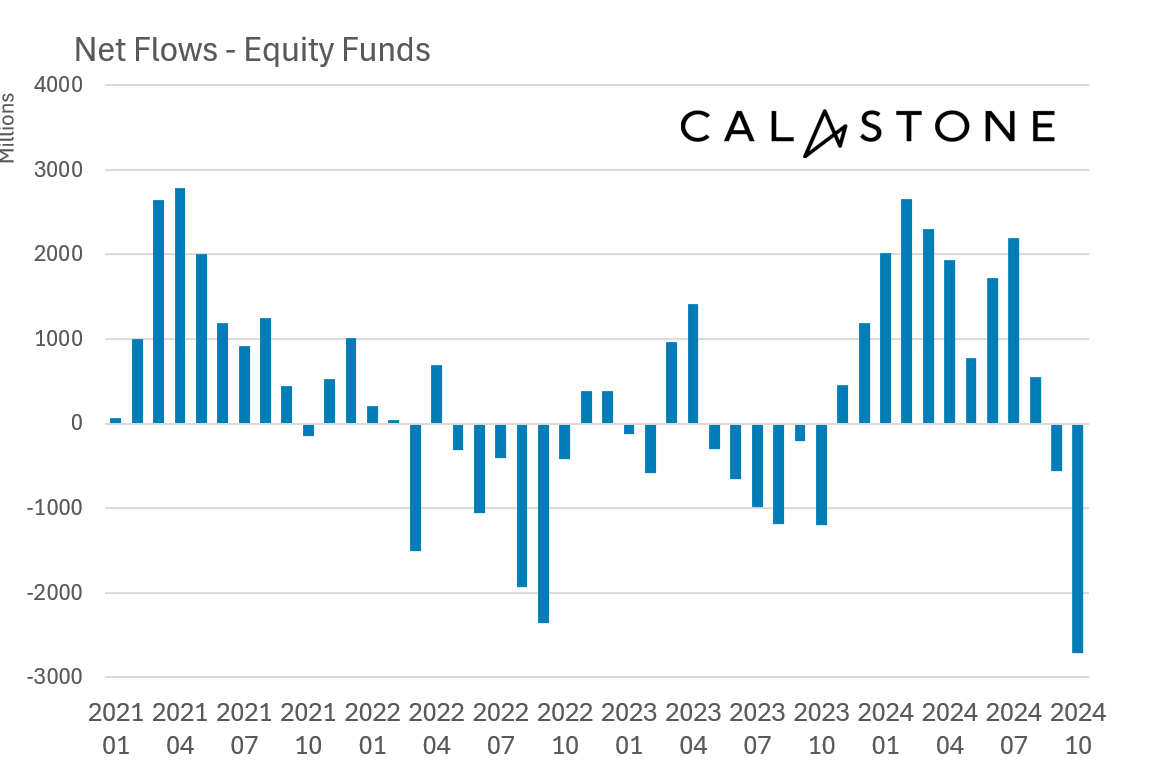

Equity funds suffered their worst month of outflows on record in October, according to the latest Fund Flow Index from Calastone, the largest global funds network. Investors sold down a net £2.71bn of their holdings, with every category of equity funds seeing outflows. The sharp outflows in October followed a weak September, which itself had seen the first outflows since October 2023.

Edward Glyn, head of global markets at Calastone said: “Fears of a Capital Gains Tax grab in last week’s budget spurred investors to book their profits and crystallize a lower tax bill well before the Chancellor rose to her feet in the Commons. Unease in September meant the early birds took fright first, but by October investors were flocking for the exits.”

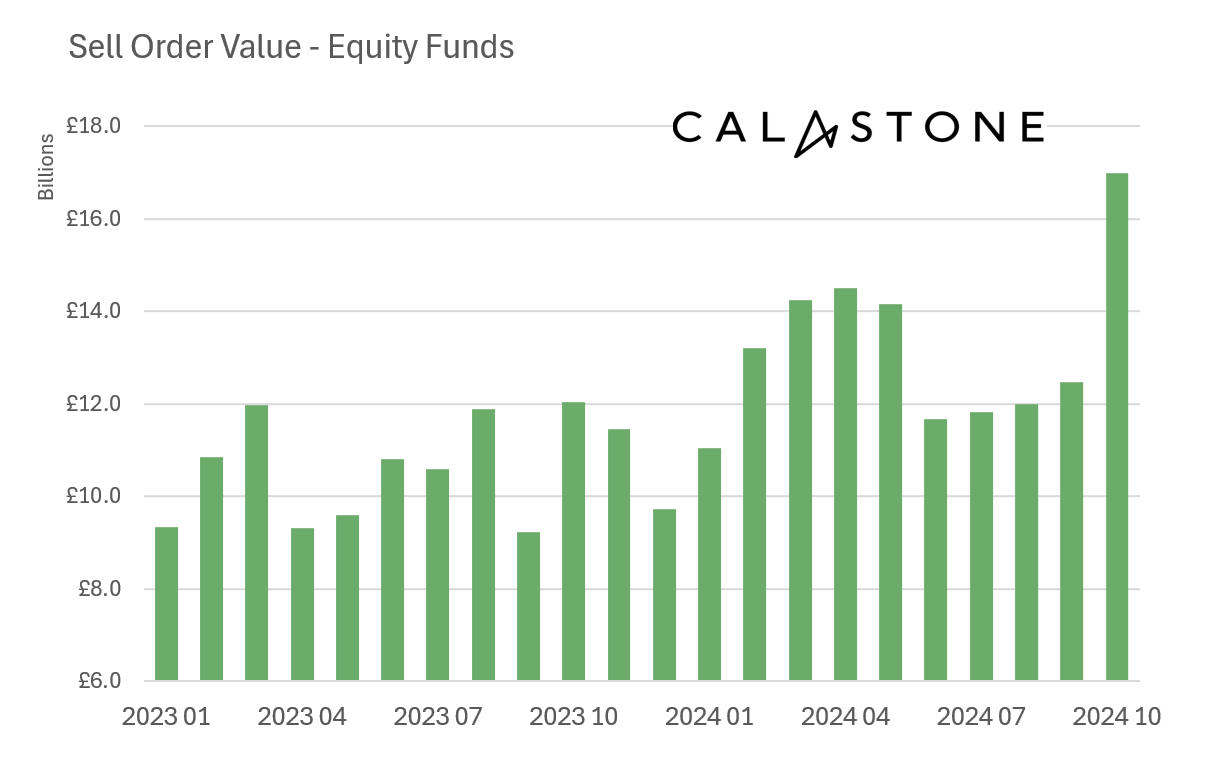

Sell orders surged 36% m-o-m but dropped 40% overnight as Capital Gains Tax hikes took effect on Budget Day

Calastone’s real-time transaction data, which covers more than 85% of the funds market, showed that sell orders surged by 36% month-on-month to a record £17.0bn (one sixth more than the previous high). Buying activity also jumped, up 20% month-on-month. Notably, outflows ceased entirely on budget day when higher Capital Gains Tax rates came into immediate effect – sell orders dropped by an astonishing 40% overnight compared to Wednesday 29th, while buying continued.

Edward Glyn explained: “There were no major catalysts in global markets to spur a rout in October – indices drifted lower in the second half of the month in response to rising bond yields, but there were no alarming moves. Instead, sharply higher selling by investors based here in the UK suggests the net outflow (the difference between the buying and selling) was driven by a motivation to book profits after strong market rises this year. Moreover, October’s robust buying activity indicates that investors were also happy enough to reinvest much of the proceeds of their sales back into funds.

“The startling change in behaviour between 29th October and Budget Day is a clear indication that tax was the main motivation for all this activity.”

UK-focused funds bore the brunt of the selling, but every equity-fund sector saw outflows

UK assets were hit hardest by far. More than one third of this, £988m, was pulled from funds focused on UK equities, the fourth worst month on record for the sector. Meanwhile another quarter, £733m, came from equity income funds, which are skewed towards the UK stock market. It was the third worst month for income funds.

Global funds saw their first outflows in more than two years

October was the first month in more than a year that UK investors withdrew cash from US equity funds (£135m), and it was the first month in more than two years[1] since global equity funds last saw a month of outflows (£263m). With US markets and global markets having risen strongly over the last year, this is a further indication that booking gains for tax purposes was a key motivation.

Bond funds saw highest inflows since June 2023 and safe-haven money market funds also saw net buying

Meanwhile, fixed income funds had their best month since June 2023. Bond yields have surged in recent weeks as investors have both reassessed the wisdom of deep rate cuts from the US Federal Reserve and have also become concerned about an expected government borrowing and spending binge in the UK. Higher bond yields push bond prices down, but they also allow newly invested capital to lock into these yields. There was an investor wobble in the middle of the month when bond yields rose fastest, prompting outflows for a few days, but for the month overall, investors added £631m in October, the best month for fixed income funds since June 2023.

Money market funds, the classic safe-haven asset class – also saw higher inflows, rising to £402m in October.

Edward Glyn concluded: “The suggestion that interest rates may stay higher for longer in the wake of the Budget made interest-earning assets like bonds and cash funds more attractive to investors.”

[1] Previous outflow was September 2022