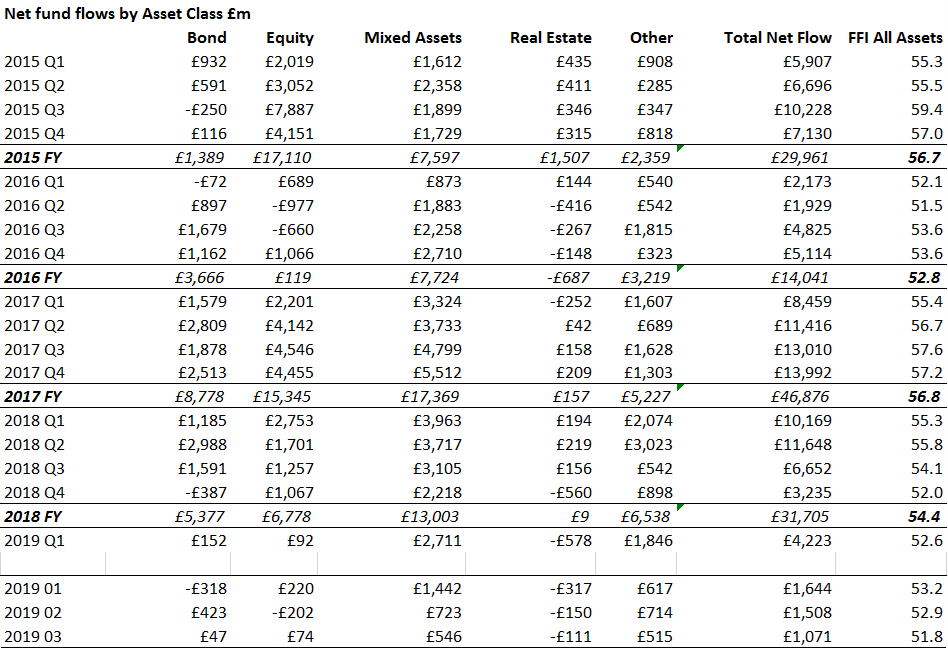

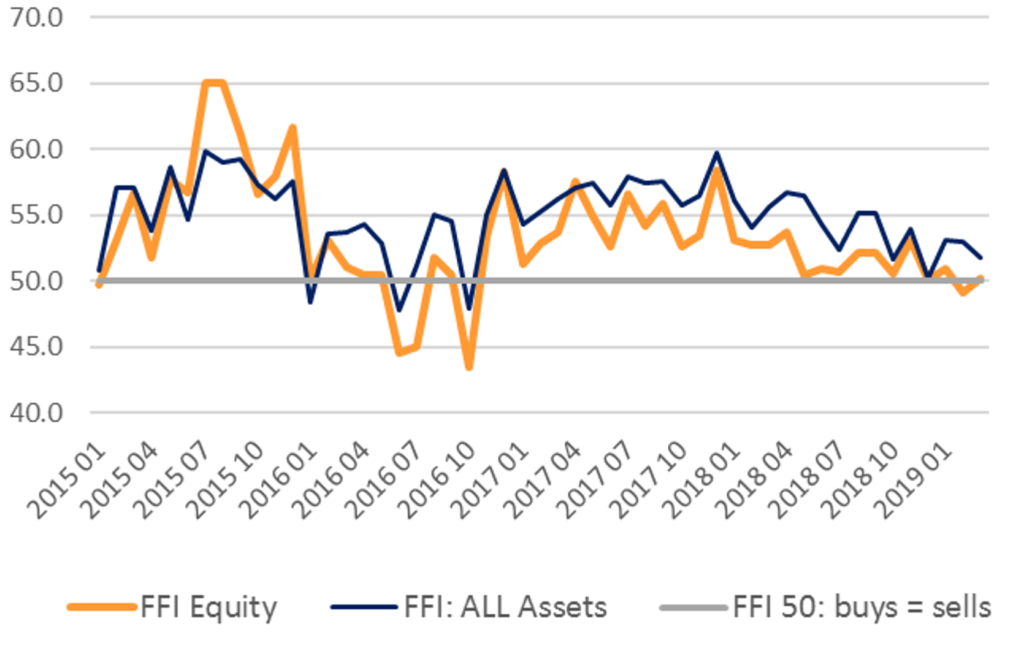

The buyers’ strike among investors in equity funds continued in March, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds transaction network. Investors added a net £74m to their equity fund holdings, resulting in an FFI: Equity of just 50.2 (a reading of 50 indicates that buys equal sells). This was the 9th weakest monthly inflow for equity funds since FFI records began. Since December, investors have added a total of just £120m to their equity fund holdings – this means it has taken four months for net inflows to equity funds to reach the level of inflows achieved on a single typical day in December 2017.

Figure 1: FFI Equity v FFI All Assets

Only UK equity, global, and Asia-Pacific funds enjoyed inflows in March. Europe, emerging markets, North America, sector, regional, and equity income funds all saw outflows. The weakest of these were funds focused on continental Europe, which have now seen a record eleven consecutive quarters of net outflows - £1.1bn has left this category in the last four months alone. Inflows to funds focused on UK equities have accelerated over the quarter, reaching £261m in March, up from just £13m in January.

Fixed income funds also saw almost no net new capital flowing in in March, a total of just £47m, but real estate funds saw £111m of outflows, taking total outflows to £578m in Q1, the worst quarter on record for the sector (further real estate detail available in a separate release – please ask us for details). Absolute return and commodity funds also saw outflows. Among the major asset classes, only mixed asset funds enjoyed new inflows, totalling £546m. Mixed asset fund inflows see less variation than other fund sectors, since they feature so prominently in regular savings plans. Over the long run, mixed asset funds have made up just over a third of net fund inflows, but in the last year when financial markets have been rather volatile, this has risen to three fifths of the total.

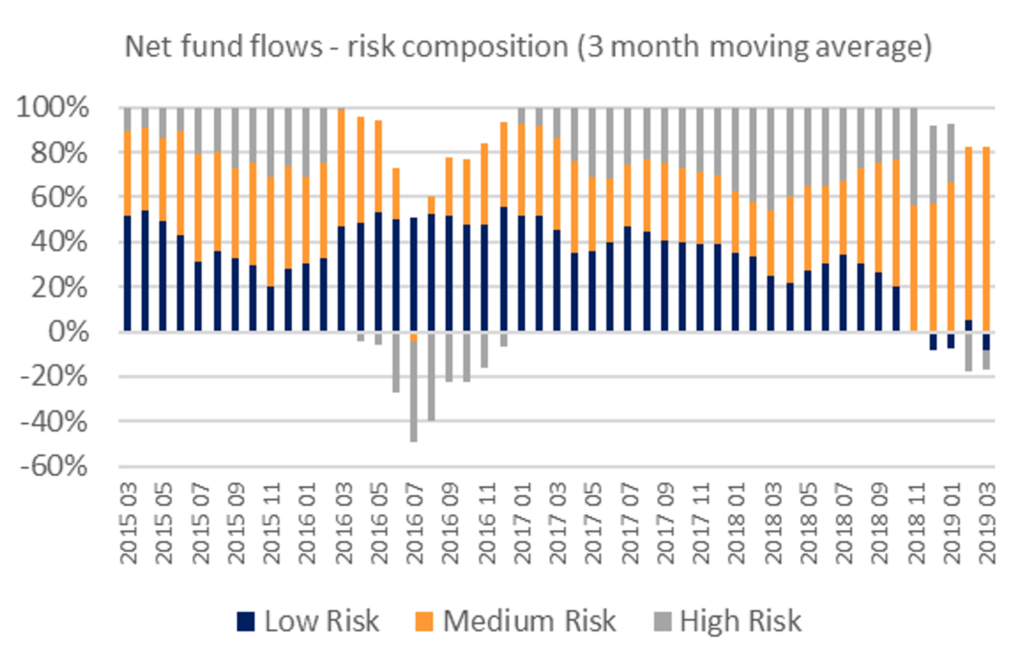

Notably, risk aversion has shot up in the last few months. Appetite for the riskier categories of funds has fallen sharply and £650m of capital has flowed out of riskier funds since December, the first time this group has seen outflows since 2016. As activity has increasingly concentrated in mixed asset funds, so the medium risk categories have come to dominate investors’ choices.

Figure 2: Proportion of inflows into each risk category of funds

Only UK equity, global, and Asia-Pacific funds enjoyed inflows in March. Europe, emerging markets, North America, sector, regional, and equity income funds all saw outflows. The weakest of these were funds focused on continental Europe, which have now seen a record eleven consecutive quarters of net outflows - £1.1bn has left this category in the last four months alone. Inflows to funds focused on UK equities have accelerated over the quarter, reaching £261m in March, up from just £13m in January.

Fixed income funds also saw almost no net new capital flowing in in March, a total of just £47m, but real estate funds saw £111m of outflows, taking total outflows to £578m in Q1, the worst quarter on record for the sector (further real estate detail available in a separate release – please ask us for details). Absolute return and commodity funds also saw outflows. Among the major asset classes, only mixed asset funds enjoyed new inflows, totalling £546m. Mixed asset fund inflows see less variation than other fund sectors, since they feature so prominently in regular savings plans. Over the long run, mixed asset funds have made up just over a third of net fund inflows, but in the last year when financial markets have been rather volatile, this has risen to three fifths of the total.

Notably, risk aversion has shot up in the last few months. Appetite for the riskier categories of funds has fallen sharply and £650m of capital has flowed out of riskier funds since December, the first time this group has seen outflows since 2016. As activity has increasingly concentrated in mixed asset funds, so the medium risk categories have come to dominate investors’ choices.

Figure 2: Proportion of inflows into each risk category of funds

In total, UK funds saw £1.1bn of inflows in March across all asset classes, generating an FFI of 51.8.

Edward Glyn, Calastone’s Head of Global Markets, comments: “Economic and political uncertainty have risen in recent months and that has markedly dampened investor enthusiasm for equities. Market volatility has calmed down considerably in recent weeks, but that’s seemingly not enough to tempt investors to add new money into equity funds, until they see more evidence that the world economy is not heading for a hard landing. Overall volumes of transactions have not been affected, however. There is above-average two-way trade in equity funds but busy buying is matched by almost equal levels of selling.

UK equity funds, paradoxically, are bucking the trend, as investors have become increasingly positive since the end of 2017 on the outlook for the UK market. UK shares are exceptionally cheap compared to overseas and historic comparisons and they have been out of favour with international buyers. UK investors are clearly seeing opportunities to pick up good value assets while the world is distracted, and put off, by the fire and fury of Brexit.

Investors’ much reduced appetite for risk is partly by default, as net flows concentrate in regular purchases of mixed asset funds, but it also reflects the lack of conviction for other asset classes while wider uncertainty persists”

In total, UK funds saw £1.1bn of inflows in March across all asset classes, generating an FFI of 51.8.

Edward Glyn, Calastone’s Head of Global Markets, comments: “Economic and political uncertainty have risen in recent months and that has markedly dampened investor enthusiasm for equities. Market volatility has calmed down considerably in recent weeks, but that’s seemingly not enough to tempt investors to add new money into equity funds, until they see more evidence that the world economy is not heading for a hard landing. Overall volumes of transactions have not been affected, however. There is above-average two-way trade in equity funds but busy buying is matched by almost equal levels of selling.

UK equity funds, paradoxically, are bucking the trend, as investors have become increasingly positive since the end of 2017 on the outlook for the UK market. UK shares are exceptionally cheap compared to overseas and historic comparisons and they have been out of favour with international buyers. UK investors are clearly seeing opportunities to pick up good value assets while the world is distracted, and put off, by the fire and fury of Brexit.

Investors’ much reduced appetite for risk is partly by default, as net flows concentrate in regular purchases of mixed asset funds, but it also reflects the lack of conviction for other asset classes while wider uncertainty persists”