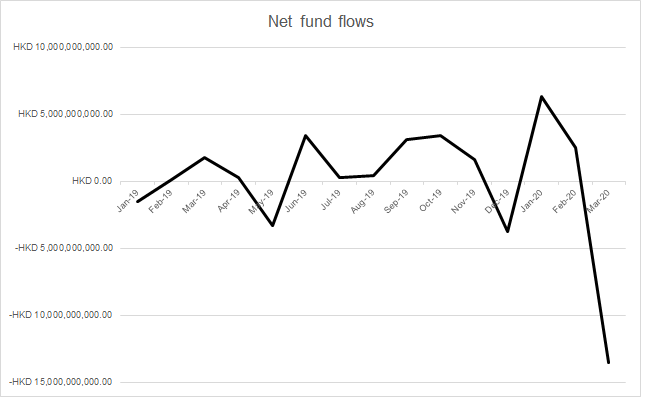

Calastone, the largest global funds network, today reveals data from its network demonstrating the impact of COVID-19 on fund flows in Hong Kong. In March, funds saw the highest level of net redemptions by far, amounting to a net outflow of HK$13.5 billion, primarily driven from bond funds. This amount shadowed the net redemptions during the social unrest period in 2019.

The first quarter of 2020 has seen net outflows overall, since the first coronavirus outbreak in China in December. However, the lion’s share of redemptions was in March, as COVID-19 cases expanded worldwide and businesses started shutting down to preserve the welfare of employees. Volatility spiked in global markets as the effects of worldwide economic recession began to be felt.

2020 has shown the extent to which global turmoil affects the sentiment of investors. The gross value of cash flowing into and out of the funds in Hong Kong so far this year is much higher than in 2019, on average, reflecting the escalation of global volatility and uncertainty ahead, at least in the near term.

For Hong Kong, the global crisis was compounded by a second wave of COVID-19 cases in late March, as travellers returned to the city and carried the virus back from Europe, Australia and North America. This amounted to a “perfect storm”, with local and global events prompting investors to retract their money in response to the current situation and in anticipation of further trouble ahead.

During the course of social unrest in 2019, Hong Kong had proven to be quite adept at adapting to ongoing uncertainty and turmoil with only May and December months showing a net redemption of HK$3.3 billion and HK$3.8 billion respectively. However, these do not compare to the significant drop seen more recently during the outbreak of coronavirus (Figure 1). This shows that investors react more dramatically to global events.

Figure 1: Net fund flows across the Calastone network from January 2019 to March 2020 for Hong Kong based fund managers

Leo Chen, Managing Director – Head of Asia at Calastone says: “COVID-19 has caused a huge crisis in confidence. Global volatility in March pushed the fund flows to the highest level of net redemptions across the Calastone network, unseen even through the protests, as investors grappled with unprecedented uncertainty. This is only likely to continue as the world struggles through the pandemic.”

The city’s quick response to the crisis in January effectively prevented mass contagion in Hong Kong, reassuring investors and in turn driving inflows. However, this has proved short-lived, as local investors show their uneasiness in the face of such a global economic challenge.

*The figures above are based on the subscriptions and redemptions across the Calastone network for Hong Kong based fund managers.